44 us treasury coupon rate

10-Year Treasury Note Definition - Investopedia Below is a chart of the 10-year Treasury yield from March 2019 to March 2020. Over that span, the yield steadily declined with expectations that the Federal Reserve would maintain low interest... Individual - Treasury Bonds: Rates & Terms We used to issue Treasury bonds in paper form. The last paper bonds matured in 2016. For information on paper Treasury bonds, contact us: Send an e-mail. Call 844-284-2676 (toll free) Write to: Treasury Retail Securities Services. P.O. Box 9150. Minneapolis, MN 55480-9150.

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-05-27 about 10-year, bonds, yield, interest rate, interest, rate, and USA.

Us treasury coupon rate

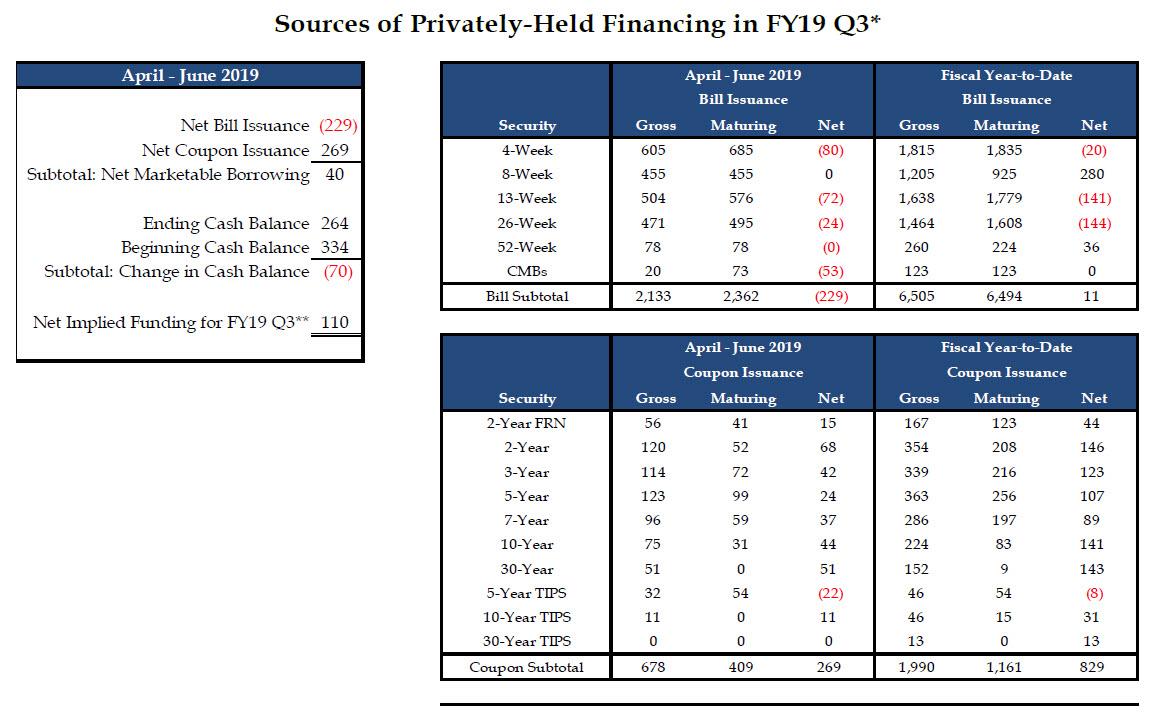

U.S. Treasury Bond Futures Quotes - CME Group CME TreasuryWatch Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. Total Cost Analysis How Is the Interest Rate on a Treasury Bond Determined? But it also means that Treasury rates are comparatively modest. As of early June 2020, the rate for a 10-year T-Bond was hovering around .66%. That is a lower typical rate than the five ... Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example. Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63%. The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Us treasury coupon rate. Government - Continued Treasury Zero Coupon Spot Rates* 3.06. 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot ... US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,282 datasets) Refreshed a day ago, on 6 Jun 2022 Frequency daily Description These yield curves are... Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The... Individual - Floating Rate Notes (FRNs): Rates & Terms The interest rate is the sum of two components: an index rate and a spread. Index rate. This rate is tied to the highest accepted discount rate of the most recent 13-week Treasury bill. We auction the 13-week bill every week, so the index rate of an FRN is re-set every week. Spread. The spread is a rate we apply to the index rate.

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.941% yield.. 10 Years vs 2 Years bond spread is 28.2 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022).. The United States credit rating is AA+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 15.90 and implied probability of default is ... Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an excellent... Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .) Important Differences Between Coupon and Yield to Maturity Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon.For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%.

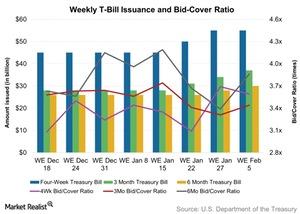

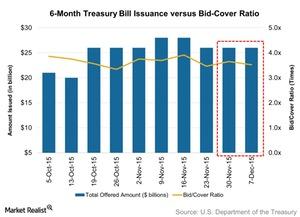

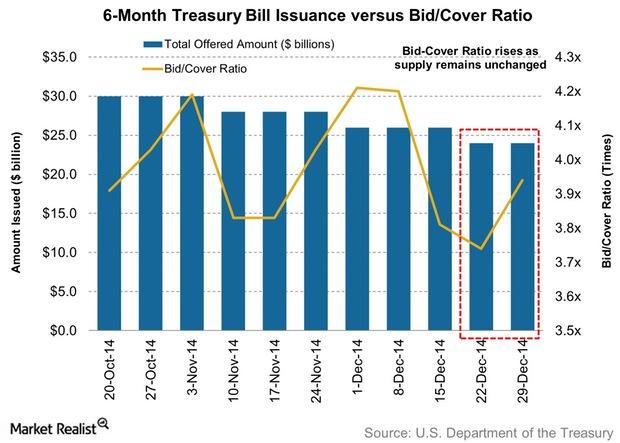

Treasury Bill Rates - NASDAQ - Datastore Treasury Bill Rates. From the data product: US Treasury (12 datasets) Refreshed 4 months ago, on 4 Feb 2022 ... The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill`s yield based on the purchase price, discount, and a 365- or 366-day year. The Coupon Equivalent can be used to compare the yield on a ...

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon.. Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity.

Resource Center | U.S. Department of the Treasury 26 WEEKS BANK DISCOUNT. COUPON EQUIVALENT. 52 WEEKS BANK DISCOUNT. COUPON EQUIVALENT. 1 Mo. 2 Mo. 3 Mo. 20 Yr. 30 Yr.

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

Interest Rates - U.S. Department of the Treasury The "Daily Treasury Long-Term Rates" are simply the arithmetic average of the daily closing bid yields on all outstanding fixed coupon bonds (i.e., inflation-indexed bonds are excluded) that are neither due nor callable for at least 10 years as of the date calculated.

Beat Inflation With A Risk Free 7% U.S. Treasury Bond At 3% this would make the year-over-year inflation rate 5.1% in March 2022. The total return calculation is: First six months return: $356 or one-half of 7.12% on $10,000. Second six months return ...

Institutional - Treasury Reopenings The coupon rate or spread of the reopening is the same as the coupon rate or spread of the original issue. The price of the reopened security could be greater than, less than, or equal to the price of the original issue. If the price determined at the reopening exceeds the par value of the security, the purchaser will owe a premium.

US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 3.083% Yield Day High 3.158% Yield Day Low 3.069% Yield Prev Close 3.075% Price 95.7344 Price Change -0.3594 Price Change % -0.375% Price Prev Close 96.0938 Price Day High 96.2188 Price...

US20Y: U.S. 20 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 3.312% Yield Day High 3.33% Yield Day Low 3.312% Yield Prev Close 3.333% Price 98.9688 Price Change +0.1719 Price Change % +0.1758% Price Prev Close 98.7969 Price Day High 99.0938 Price...

Treasury Yield Definition - Investopedia Treasury yield is the return on investment, expressed as a percentage, on the U.S. government's debt obligations. Looked at another way, the Treasury yield is the interest rate that the U.S ...

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example. Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63%. The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

How Is the Interest Rate on a Treasury Bond Determined? But it also means that Treasury rates are comparatively modest. As of early June 2020, the rate for a 10-year T-Bond was hovering around .66%. That is a lower typical rate than the five ...

U.S. Treasury Bond Futures Quotes - CME Group CME TreasuryWatch Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. Total Cost Analysis

Post a Comment for "44 us treasury coupon rate"