44 valuing zero coupon bonds

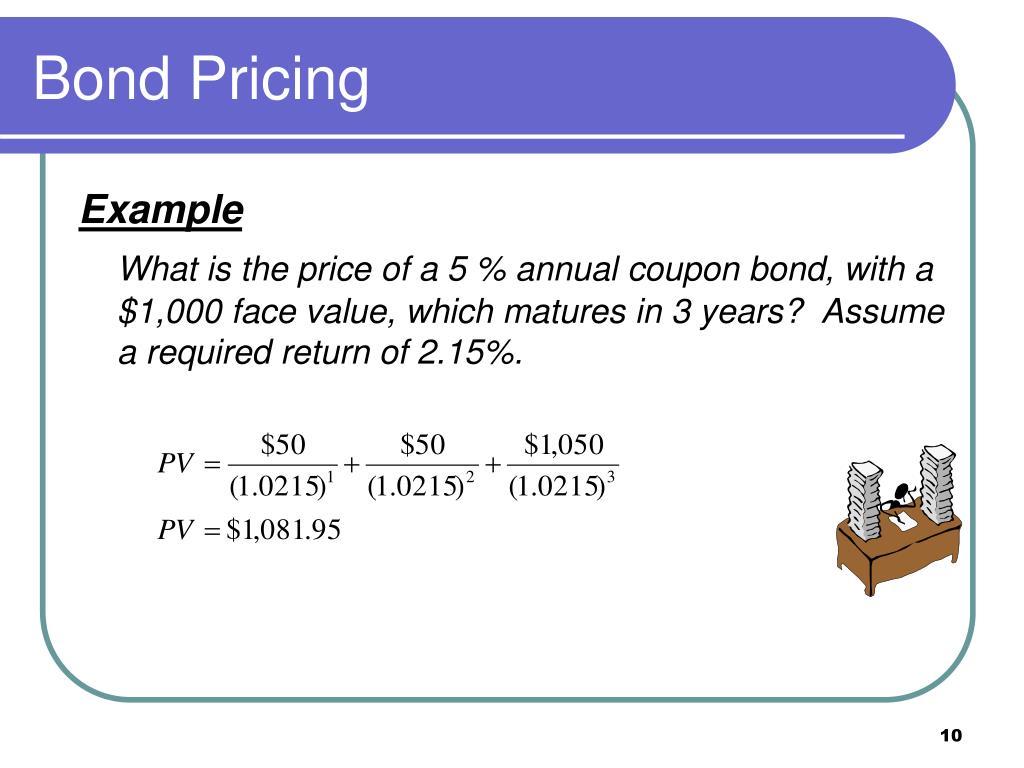

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

Valuing zero coupon bonds

Zero - Coupon Bonds - Economy Blatt The yield to maturity of a bond is the discount rate that sets the present value of the promised bond payments equal to the current market price of the bond. The yield to maturity of a zero - coupon bond is the return an investor can earn from holding the bond to maturity and receiving the promised face value payment. We can determine the yield to maturity of the one - year zero - coupon bond discussed above. 144,927 = 150,000 / (1+ YTM 1) 1 + YTM 1. 1+ YTM 1 = 1.035. YTM 1 = 3.5% Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity Value and Yield of a Zero-Coupon Bond | Formula & Example The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ...

Valuing zero coupon bonds. Understanding Zero Coupon Bonds - Part One - The Balance Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value. Some issuers may call zeros before maturity. You must pay tax on interest annually even though you don't receive it until maturity. Zero coupon bonds are more volatile than regular bonds. Of the three kinds of zero coupon bonds ... How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the bond. PDF Numerical Example in Valuing Zero coupon Bonds For example, the value of a zero coupon bond will increase from $385.00 to $620.92 as the bond moves from 10 years to maturity to 5 years to maturity assuming interest rates remain at 10%. 4) Compare the value of the zero at 10 years to maturity when rates are 10% versus when they are 7%. Lower interest rates mean higher bond prices. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Zero-Coupon Bond Value Formula. Price of Bond (PV) = FV / (1 + r) ^ t; Where: PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) t = Number of Compounding Periods

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. Zero Coupon Bonds Explained (With Examples) - Fervent The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Consider an example of Swindon PLC, which is issuing a zero coupon bond with a par value of £100 to be paid in one year's time. Zero Coupon Bonds - Financial Edge Training Value and YTM of Zero Coupon Bonds. Bonds are valued by calculating the present value of future cash flows using an appropriate discount rate or interest rate. You can calculate the price of a bond using this formula: Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity. Advantages and Risks of Zero Coupon Treasury Bonds Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000 bond can be purchased for far less than half of that amount.

Valuing a zero-coupon bond - Mastering Python for Finance [Book] A zero-coupon bond is a bond that does not pay any periodic interest except on maturity, where the principal or face value is repaid. Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, is the annually compounded yield or rate of the bond, ... Solved 2. Valuing a Zero-Coupon Bond. Assume the following | Chegg.com Answer to Solved 2. Valuing a Zero-Coupon Bond. Assume the following Zero Coupon Bond (Definition, Formula, Examples, Calculations) Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Zero Coupon Bond Calculator - What is the Market Value? What's the zero coupon bond pricing formula? The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP. where: P: The par or face value of the zero coupon bond. r: The interest rate of the bond. t: The time to maturity of the bond.

Zero Coupon Bond Value Formula - Crunch Numbers Price of the zero-coupon bond is calculated much easier than a coupon bond price since there are no coupon payments. It is calculated as: P = \frac{M}{(1 + r)^{n}} Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is the number of years until maturity. Example of price of a zero-coupon ...

Valuation of Zero-Coupon Bonds - YouTube This video provides an explanation of a zero-coupon bond and proceeds to show how the value and yield are calculated using manual computations as well as wit...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org the value of your zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000.

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Calculate the Value of a Zero-coupon Bond - Finance Train Calculate the Value of a Zero-coupon Bond. Suppose you have a pure discount bond that will pay $1,000 five years from today. The bond discount rate is 12%. ... Since there are no interim coupon payments, the value of the bond will simply be the present value of single payment at maturity. Checkout our eBooks.

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... R = required rate of return (or interest rate) N = number of years till maturity. These bonds can either offer annual compounding or semi-annual compounding. In the case where the bonds offer semi-annual compounding the following formula is used to calculate the price of the bond: Price = M / (1 + r/2) ^ n*2.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds. To illustrate, assume that on January 1, Year One, a company offers a $20,000 two-year zero-coupon bond to the public. A single payment of $20,000 will be made to the bondholder on December 31, Year Two.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://i.ytimg.com/vi/69R6CrIUZ0k/hqdefault.jpg)

Post a Comment for "44 valuing zero coupon bonds"