39 relationship between coupon rate and ytm

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. What relationship between a bond's coupon rate and ... - Quora If the bond yield is less than the bond's coupon rate, then the bond will trade at a premium. Likewise, if the bond yield is more than the bond's coupon rate, ...5 answers · 7 votes: Thanks for the A2A. All the bonds have coupon interest rate, sometimes also referred to as ...

EOF

Relationship between coupon rate and ytm

thismatter.com › money › bondsDuration and Convexity, with Illustrations and Formulas In fact, a very simple relationship exists between the two: when the YTM changes by 1%, the bond price changes by the duration converted to a percentage. So, for instance, the price of a bond with a 10-year duration would change by 10% for a 1% change in the interest rate. Macaulay Duration › terms › bBond Yield Definition - Investopedia Jan 01, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Solved Calculate the yield to maturity (YTM) on this bond. | Chegg.com Question: Calculate the yield to maturity (YTM) on this bond. Explain the relationship that exists between the coupon interest rate and yield to maturity and the par value and market value of a bond. Kidd to maturity Each of the bonds shown in the following table pays interest annually. Calculate the yield to maturity (YTM) for cache bond.

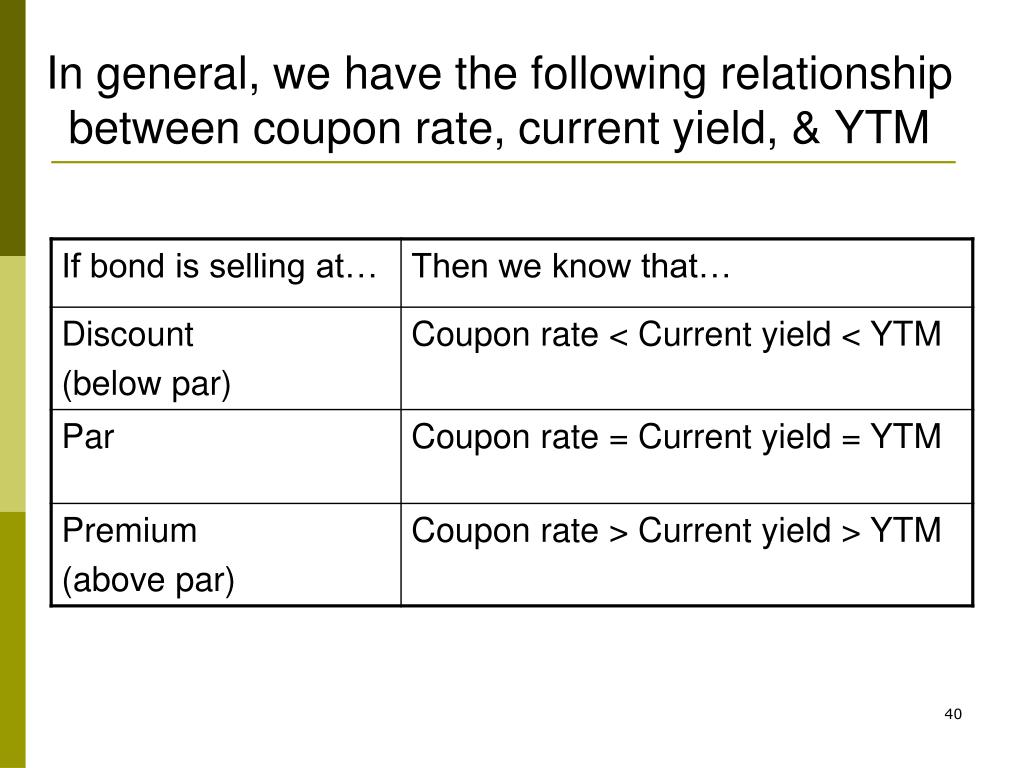

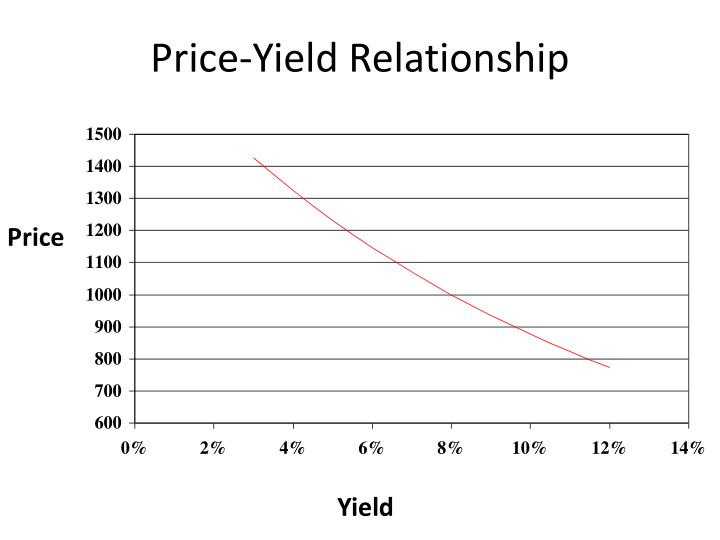

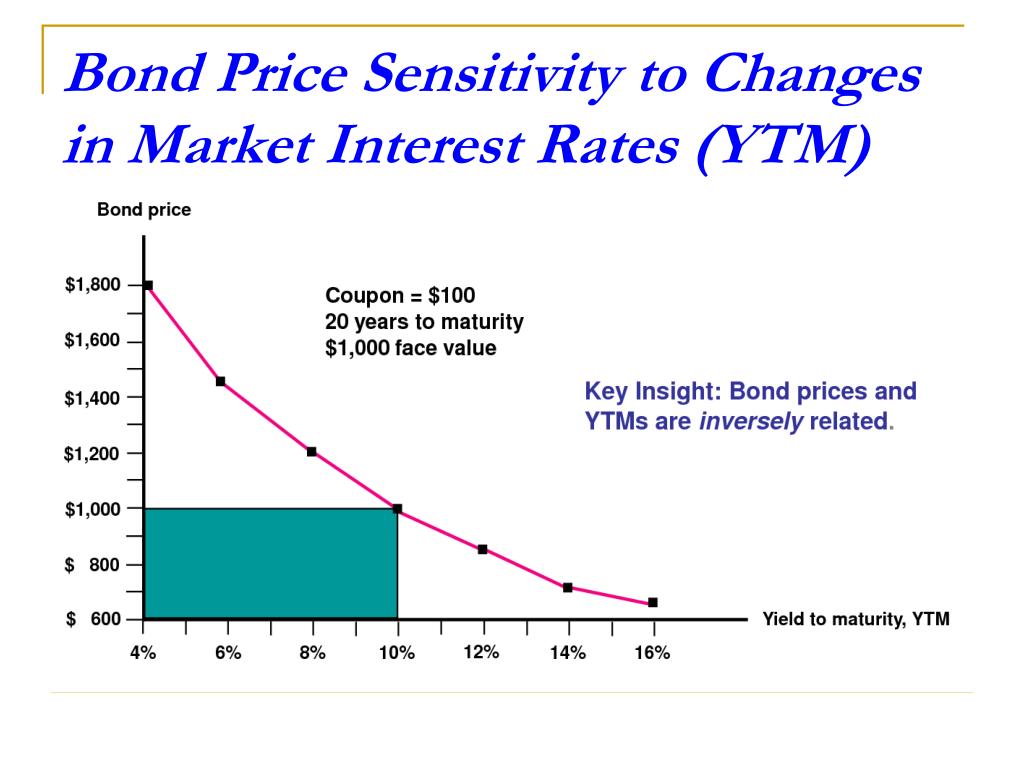

Relationship between coupon rate and ytm. Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. The bond shown in the following table pays | Chegg.com Par value $1,000 Coupon interest rate 9% Years to maturity 8 Current value $820 a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain. a. The yield to maturity (YTM) for the bond is%. (Round to two decimal ... investspectrum.com › uma › duration-vs-maturityDuration vs. Maturity and Why the Difference Matters Sep 01, 2017 · See the diagram below to understand the relationship between the bond’s price and its interest rate (or coupon rate). A bond is quoted with its “coupon yield”. This refers to the annual interest payable as a percent of the original face or par value. An 8% bond with a par value of 1000 would receive $80 per year. Coupon/Interest Rate= 8% ...

Solved Par value Coupon interest rate Years to | Chegg.com Calculate the yield to maturity (YTM ) for the bond. (2 decimal places) b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value; Question: Par value Coupon interest rate Years to maturity Current value $100 7 % 14 $70 a. Calculate the yield to maturity (YTM ) for the bond. Bond Yield | Nominal Yield vs Current Yield vs YTM Where P 0 is the current bond price, c is the annual coupon rate, m is the number of coupon payments per year, YTM is the yield to maturity, n is the number of years the bond has till maturity and F is the face value of the bond.. The above equation must be solved through hit-and-trial method, i.e. you plug-in different numbers till you get the right hand side of the equation equal to the left ... Relationship Between Coupon and Yield - Assignment Worker YTM with Semiannual Coupons. 40 N. 1197.93 PV (negative) 1000 FV. 50 PMT. CPT PV 4% (= ½ YTM) YTM = 4%*2 = 8%. NOTE: Solving a semi-annual payer for YTM. results in a 6-month yield. The calculator & Excel. solve what you enter. The 4% value is the 6-month interest rate. YTM is an annual rate. The Relationship Between a Bond's Price & Yield to Maturity That's because your yield to maturity at the time you buy the bond is based on receiving the full maturity value of the bond, typically $1,000. If you sell a bond before it comes due, you'll receive whatever the current market value is for your bond, which may be more or less than you paid. As a result, your yield to maturity will vary.

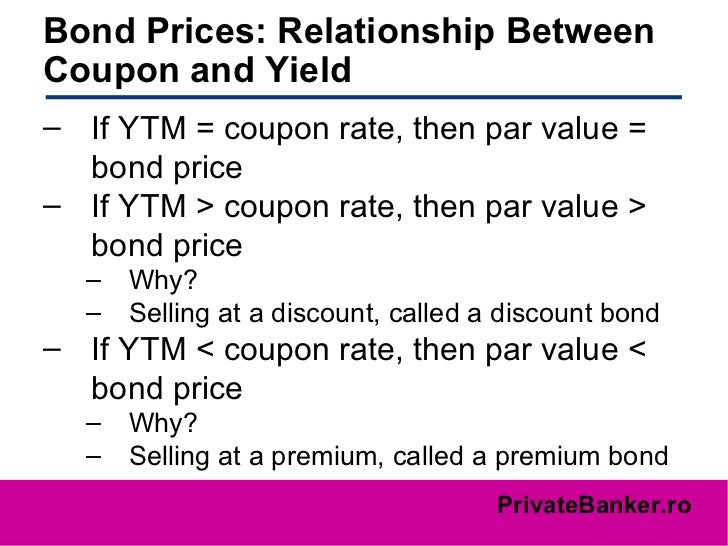

What relationship between a bond's coupon rate and a bond's yield would ... Is YTM the same thing as the coupon rate? Suppose today a 10 percent coupon bond sells at par. Two years from now, the required return on the same bond is 8 percent. YTM is the rate relative to the present value of the bond. It is not the coupon rate which is relatively useless nor does it have anything to do with required rate of return. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. 1 It is the sum of all of its remaining coupon payments.... Returns, Spreads, and Yields | AnalystPrep - FRM Part 1 Study Notes If the coupon rate < YTM, the bond will sell for less than par value, or at a discount. If coupon rate= YTM, the bond will sell for par value. Over time, the price of premium bonds will gradually fall until they trade at par value at maturity. Similarly, the price of discount bonds will gradually rise to par value as maturity gets closer. investinganswers.com › dictionary › bBond | Meaning & Examples | InvestingAnswers Nov 25, 2020 · The Yield-to-Maturity Formula. If a bond is held until maturity, the bondholder’s return is called the Yield to Maturity (YTM). The YTM Formula can be calculated as follows: To calculate the yield to maturity, you need to know: the interest or coupon payment. the face value of the bond. the current market price of the bond.

Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

financetrainingcourse.com › education › 2012How to calculate Spot Rates, Forward Rates & YTM in EXCEL Jan 31, 2012 · c. How to calculate the Yield to Maturity (YTM) of a bond. The equation below gives the value of a bond at time 0. The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond).

Coupon vs Yield | Top 5 Differences (with Infographics) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Let's see the top differences between coupon vs. yield.

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Estimate the interest rate by considering the relationship between the bond price and the yield. You don’t have to make random guesses about what the interest rate might be. Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate.

The Relation of Interest Rate & Yield to Maturity - Pocketsense Most brokerage firms offer YTM estimates on potential purchases, and there are number of online calculators you can use to make estimates based on coupon rate and maturity date. In the example, if you paid a premium for the same six-year bond, say $101, your estimated YTM would decrease to about 4.8 percent, or about $28.80.

Relationship Between Coupon Rate Yield To Maturity And Current Yield yield and rate maturity relationship current coupon to yield between. The enclosure is a patented, durable design which interlocks with the jump mat v-rings using a button-hole feature, eliminating gaps. relationship between coupon rate yield to maturity and current yieldgap 40 off coupon december 2012. American Paint Horse Gifts

› ~zz1802 › Finance 303Chapter 6 -- Interest Rates (2) Yield to maturity (YTM): the return from a bond if it is held to maturity Example: a 10-year bond carries a 6% coupon rate and pays interest semiannually. The market price of the bond is $910.00. What should be YTM for the bond? YTM = 3.64%*2 = 7.28% (3) Yield to call: the return from a bond if it is held until called

Solved Calculate the yield to maturity (YTM) on this bond. | Chegg.com Question: Calculate the yield to maturity (YTM) on this bond. Explain the relationship that exists between the coupon interest rate and yield to maturity and the par value and market value of a bond. Kidd to maturity Each of the bonds shown in the following table pays interest annually. Calculate the yield to maturity (YTM) for cache bond.

› terms › bBond Yield Definition - Investopedia Jan 01, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

thismatter.com › money › bondsDuration and Convexity, with Illustrations and Formulas In fact, a very simple relationship exists between the two: when the YTM changes by 1%, the bond price changes by the duration converted to a percentage. So, for instance, the price of a bond with a 10-year duration would change by 10% for a 1% change in the interest rate. Macaulay Duration

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://efinancemanagement.com/wp-content/uploads/2019/01/Coupon-Rate.png)

Post a Comment for "39 relationship between coupon rate and ytm"