41 ytm zero coupon bond

What is Bond - Meaning, Types & YTM Calculation Process - Scripbox Zero coupon bond: Zero coupon bond is a bond with a zero coupon rate. The bond issuer pays only the principal amount to the investor on maturity. They do not make any coupon payments. However, they are issued at a discount to their par value. The bondholder generates returns once the issuer repays the amount at face value. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

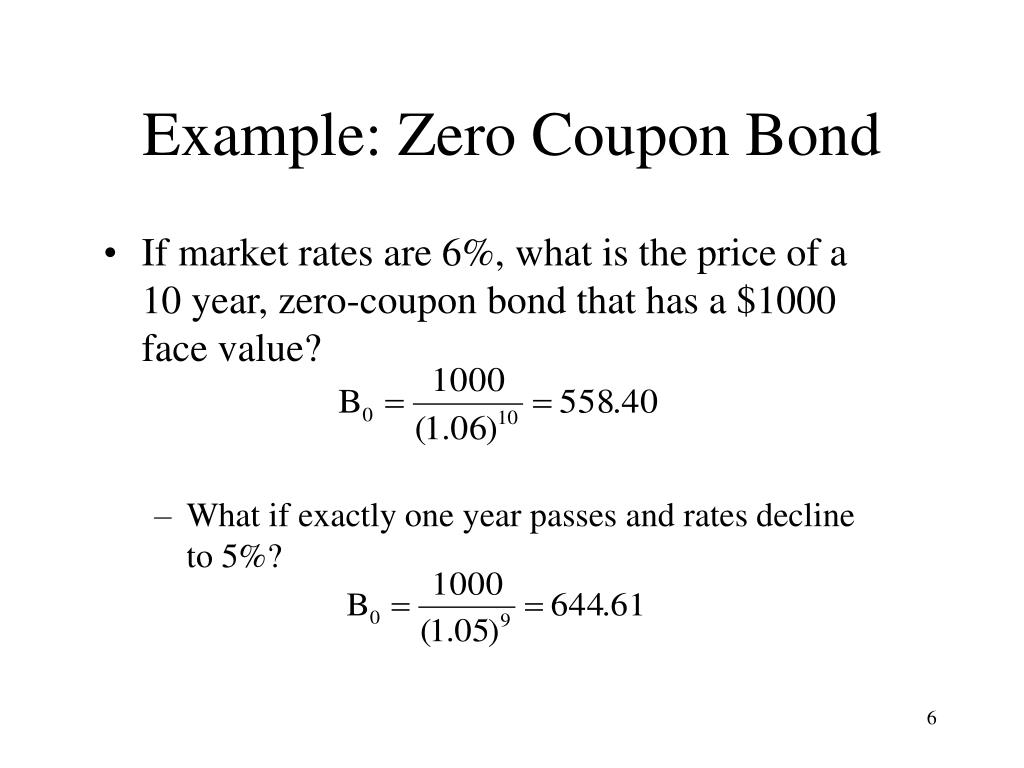

How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

Ytm zero coupon bond

Discount Bond - Bonds Issued at Lower Than Their Par Value A discount bond is a bond that is issued at a lower price than its par value or a bond that is trading in the secondary market at a price that is below the par value. It is similar to a zero-coupon bond, only that the latter does not pay interest until maturity. A bond is considered to trade at a discount when its coupon rate is lower than the ... Zero Coupon Bond: Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds ... How to calculate yield to maturity in Excel (Free Excel Template) The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. So, pmt will be $1000 x 3% = $30. PV = Present value of the bond. It is the amount that you spend to buy a bond. So, it is negative in the RATE function. FV = Future value of the bond. It is actually the face value of the bond.

Ytm zero coupon bond. dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Simply put, it is a type of fixed-income security that does not pay interest on the principal amount. To compensate for the lack of coupon payment, a zero-coupon bond typically trades at a...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an excellent... › terms › yYield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund - PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund. Share. ... est. yield to maturity. As of 08/22/2022. Distributions 30 Day Sec Yield Estimated Yield To Maturity ... YTM accounts for the present value of a bond's future coupon payments. PIMCO calculates a Fund's Estimated YTM by averaging the YTM of each security held in the Fund ... › ask › answersCurrent Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · For example, a bond with a $1,000 par value and a 7% coupon rate pays $70 in interest annually. Current Yield of Bonds The current yield of a bond is calculated by dividing the annual coupon ... How To Calculate YTM (Years To Maturity) On A Financial Calculator The calculator will now give you the YTM, or years to maturity, for the bond. Keep in mind that this is only an estimate, as actual YTM can vary depending on market conditions. ... 1500 at maturity when the interest rate have dropped to 2%, the net return will be -151.6% (10-year zero coupon Treasury note of 2019 price is still $918.84 ... Zero-Coupon Bond - Definition, How It Works, Formula What is a Zero-Coupon Bond? A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest.

Calculating the YTM's of default free zero coupon bonds - BrainMass The following table summarizes prices of various default- free zero coupon bonds (expressed as a percentage of face value) Maturity (years) 1. 2. 3. 4.

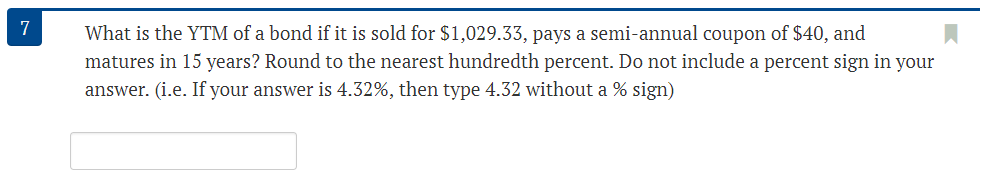

› yield-to-maturity-ytmYield to Maturity (YTM) - Wall Street Prep As for our last input, we multiply the semi-annual coupon rate by the face value of the bond (FV) to arrive at the annual coupon of the bond. Yield to Maturity (YTM) Example Calculation. With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM).

Zero Coupon Bond: Calculate the YTM (yield to maturity) - BrainMass Solution Preview 1. Step 1 Look at the value of the bond when it will reach maturity. We have a bond which will be worth $1000 in ten years. 2. Step 2 Check the price that you paid for the bond. We have $459. 3. Step 3 Subtract the number of years between the zero coupon bonds maturity ... Solution Summary

Yield to Maturity - YTM vs. Spot Rate. What's the Difference? Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows:...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula...

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds [ edit ] For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price algebraically.

Yield to Maturity Formula & Examples | How to Calculate YTM - Video ... Solutions. First, for all the problems, calculate the coupon or interest payment each year by finding 6.5% of $150. $150 (0.065) = $9.75. Then, use the YTM formula for all situations below with C ...

Post a Comment for "41 ytm zero coupon bond"