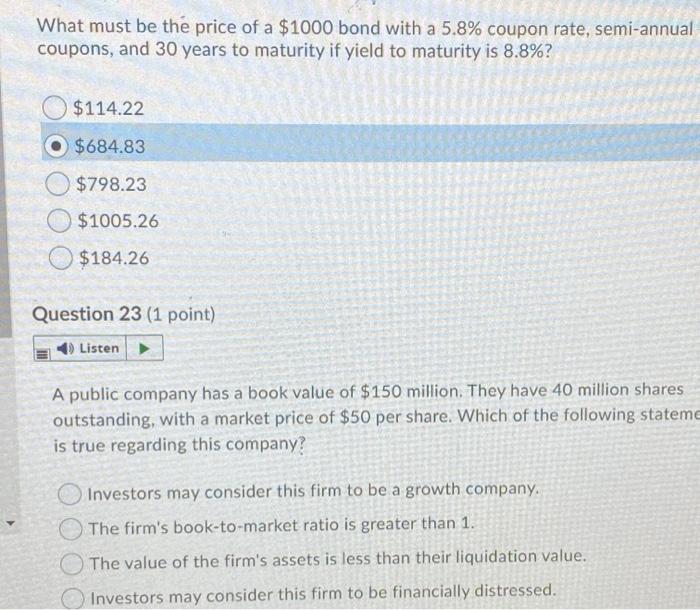

43 coupon rate semi annual

treasury bond price -- does NOT make sense, pls help! Treasury bonds and notes are quite similar in that they are issued at par and pay interest via a fixed coupon rate. The frequency of payments can vary, but annual and semi-annual payments are common. Notes will typically have a shorter term than bonds. Treasury bills, or T-bills, are issued at a discount to par. › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Let us take an example of a bond with semi-annual coupon payments. Let us assume a company ABC Ltd has issued a bond having the face value of $100,000 carrying a coupon rate of 8% to be paid semi-annually and maturing in 5 years.

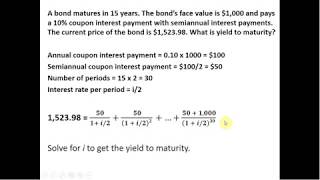

Fixed Income- Valuation : r/CFA You should do these problems on you TI BA2 plus calculator. PV = 80 FV = 100 N = 10 (5 years semi-annual) PMT = 0 (because it's a zero coupon bond) CPT -> I/Y (calculates interest per period, not year in this case) Because the calculated rate is semi annual here, multiply that x2 to get the annual rate.

Coupon rate semi annual

mm2 Asia to move forward with S$54m bond deal for cinema business The exchangeable bonds bear a coupon rate of 5 per cent per annum, payable on a semi-annual basis, with a tenure of 3 years. Should the bondholder elect to exchange at the end of the second year, the bondholder will receive shares of mm Connect constituting 60 per cent of the share capital, at a base valuation of S$90 million. South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.885% yield. 10 Years vs 2 Years bond spread is 368.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 6.25% (last modification in September 2022). The South Africa credit rating is BB-, according to Standard & Poor's agency. Bond Pricing Formula | How to Calculate Bond Price? | Examples Let us take an example of a bond with semi-annual coupon payments. Let us assume a company ABC Ltd has issued a bond having the face value of $100,000 carrying a coupon rate of 8% to be paid semi-annually and maturing in 5 years. The prevailing market rate of interest is 7%. Hence, the price of the bond calculation using the above formula as, Since the coupon rate is …

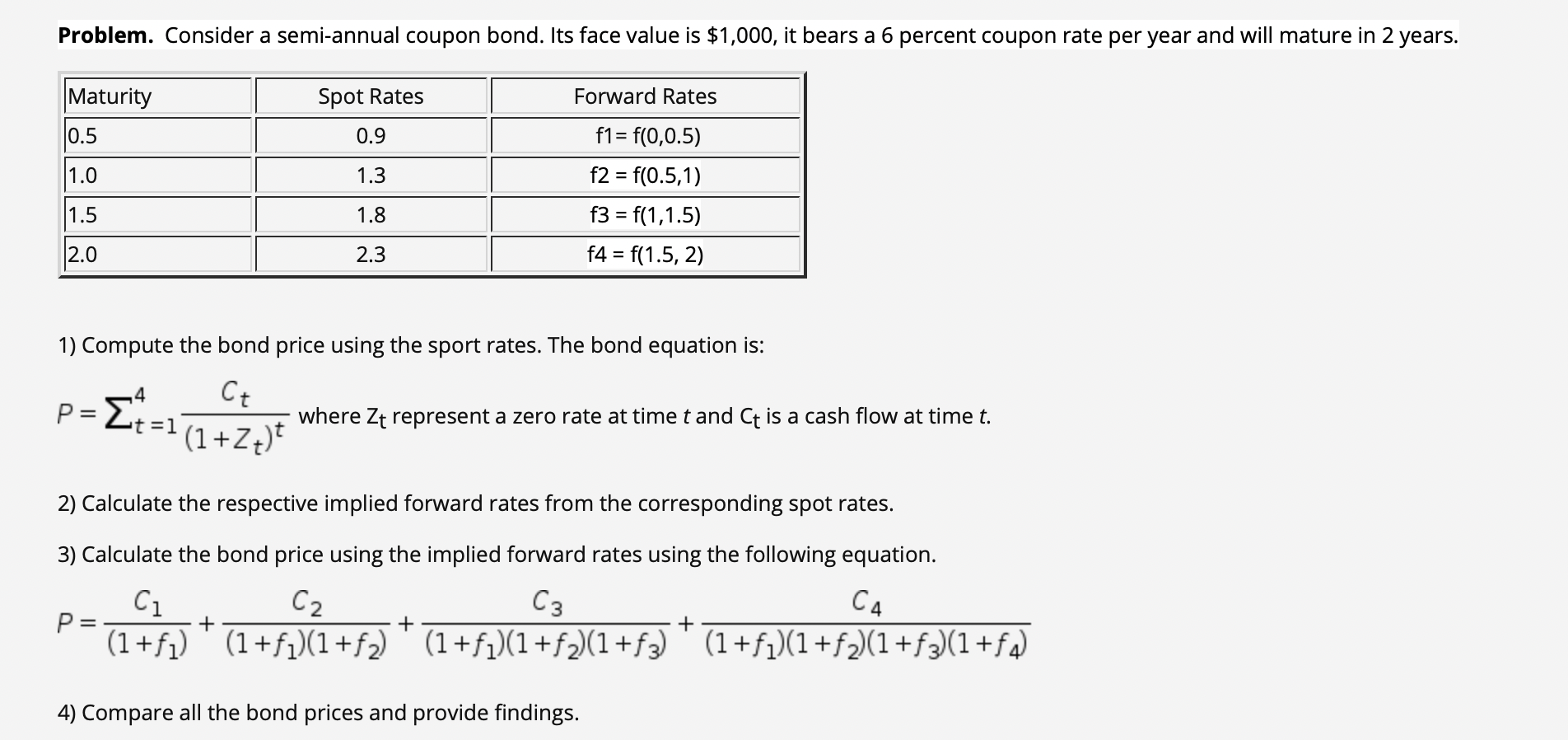

Coupon rate semi annual. Zero Rates - BrainMass C 18 months $6.20 $100.00 $101.00 D 24 months $8.00 $100.00 $104.00 Note: We assume semi annual coupon payments on coupon bonds and semi annual compounding We first calculate the zero rates for 6 months and ... Solution Summary Calculate rates for maturities of 6, 12, 18 and 24 months $2.49 Add Solution to Cart ADVERTISEMENT Guggenheim Strategic Opportunities Fund | Guggenheim Investments 4 Expense ratios are annualized and reflect the Fund's operating expense, including interest expense, or in the case of a fund with a fee waiver, net operating expense, as of the most recent annual or semi-annual report. The expense ratio, based on common assets, excluding interest expense was 1.51%. Investment Objective What Is Bond Yield? - Investopedia 31.05.2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Weekly Forecast, September 23, 2022: Peak In 1-Month Forward Treasury ... In this section we present the detailed probability distribution for both the 3-month Treasury bill rate and the 10-year U.S. Treasury yield 10 years forward using semi-annual time steps. We...

What's the Difference Between Short-Term and Long-Term ... - Acorns Other Treasury bonds pay interest in an amount that is half their "coupon rate" on a semiannual basis. For instance, say you have a $10,000, 10-year Treasury note with a coupon rate of 2 percent. Every six months, you'll receive a payment of $100 from the government. When your note matures, you can redeem it for $10,000. Zero-Coupon Bond - Definition, How It Works, Formula 28.01.2022 · Example 2: Semi-annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? 5*2 = $781.20. The price that John will pay for the bond today is $781.20. Reinvestment Risk and ... 3 Ways to Calculate Annual Interest on Bonds - wikiHow 29.03.2019 · Also, the yield, or the return, on the bond equals the interest rate. To calculate the annual interest, you need to know the coupon rate and the price of the bond. For example, Company QRS issues 5-year, $500,000, 10 percent bonds, with interest paid semi-annually. The market interest rate is 10 percent, so the bond is issued at par. ... South Africa 5 Years Bond - Historical Data - World Government Bonds Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column contains prices at the current market yield. Other columns refers to hypothetical yields variations (100 bp = 1%). If data are not all visible, swipe table left. Coupon Rate Bond Price at different Yields-100 bp-50 bp-25 bp 9.415%

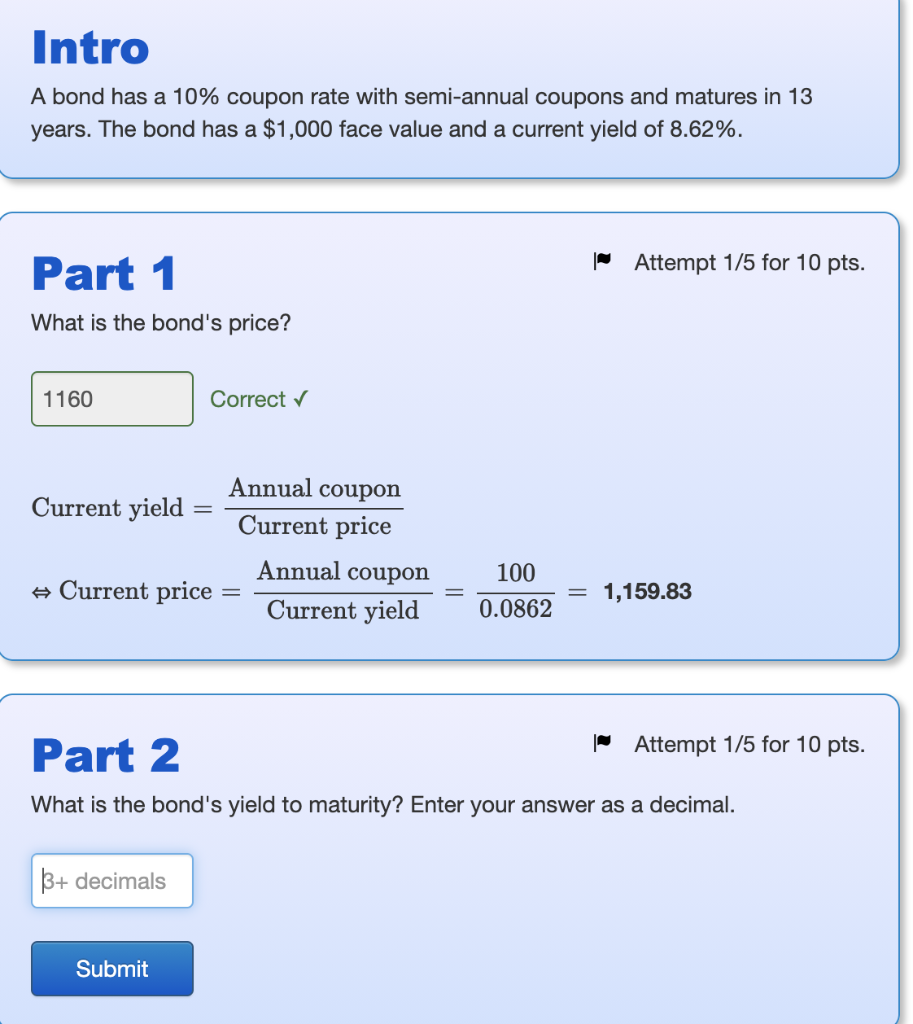

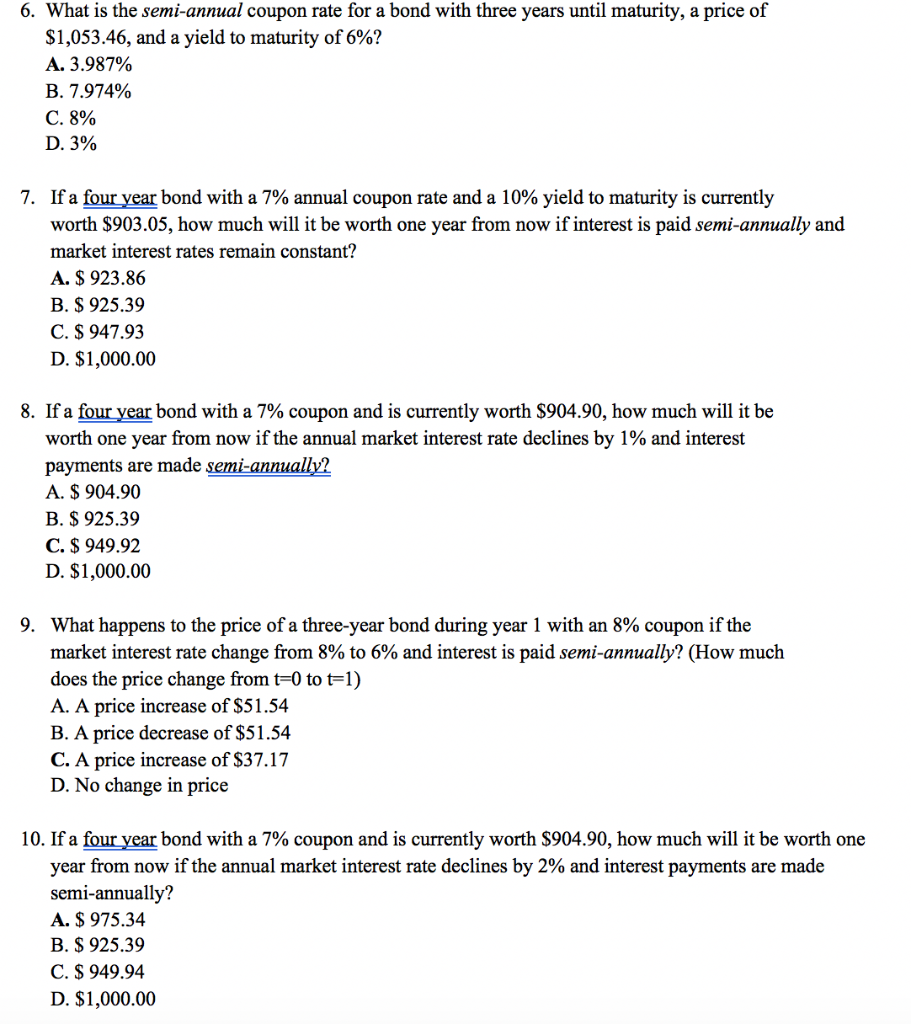

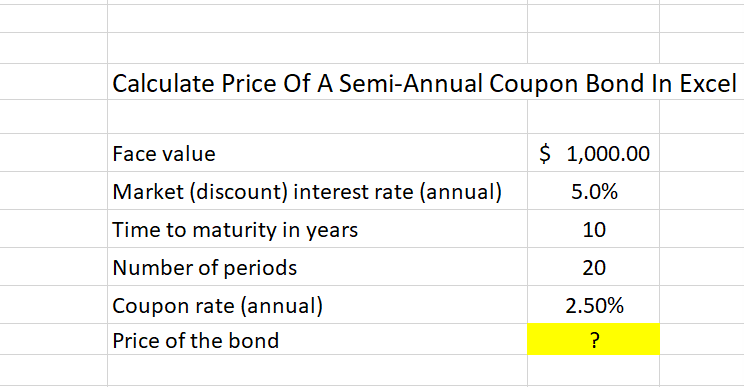

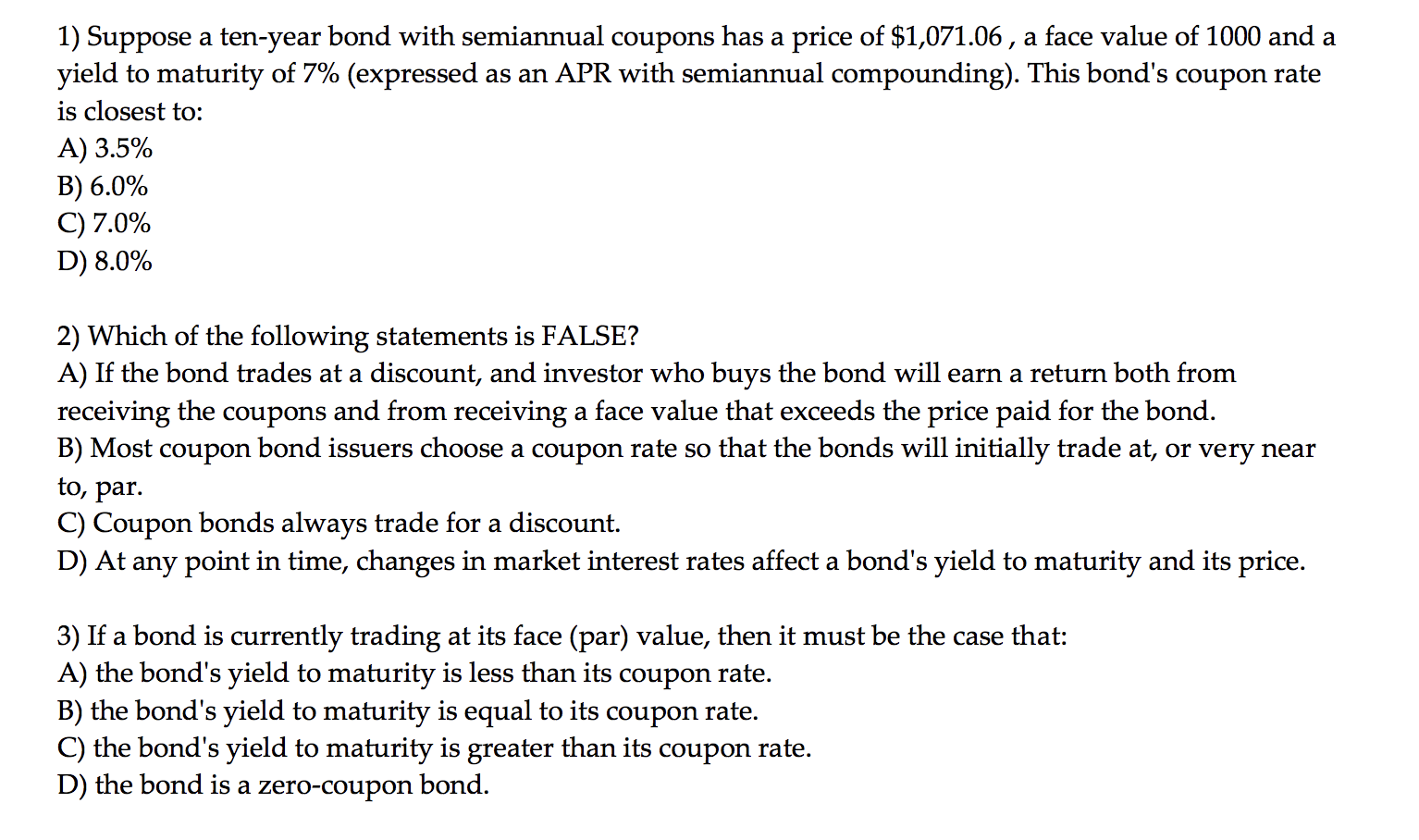

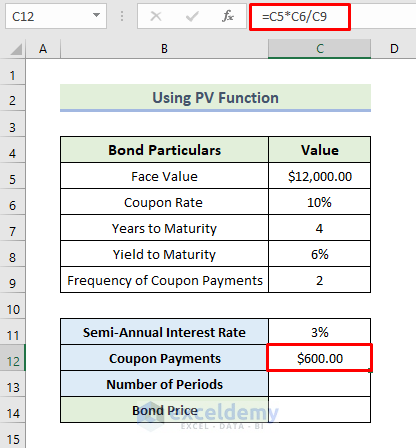

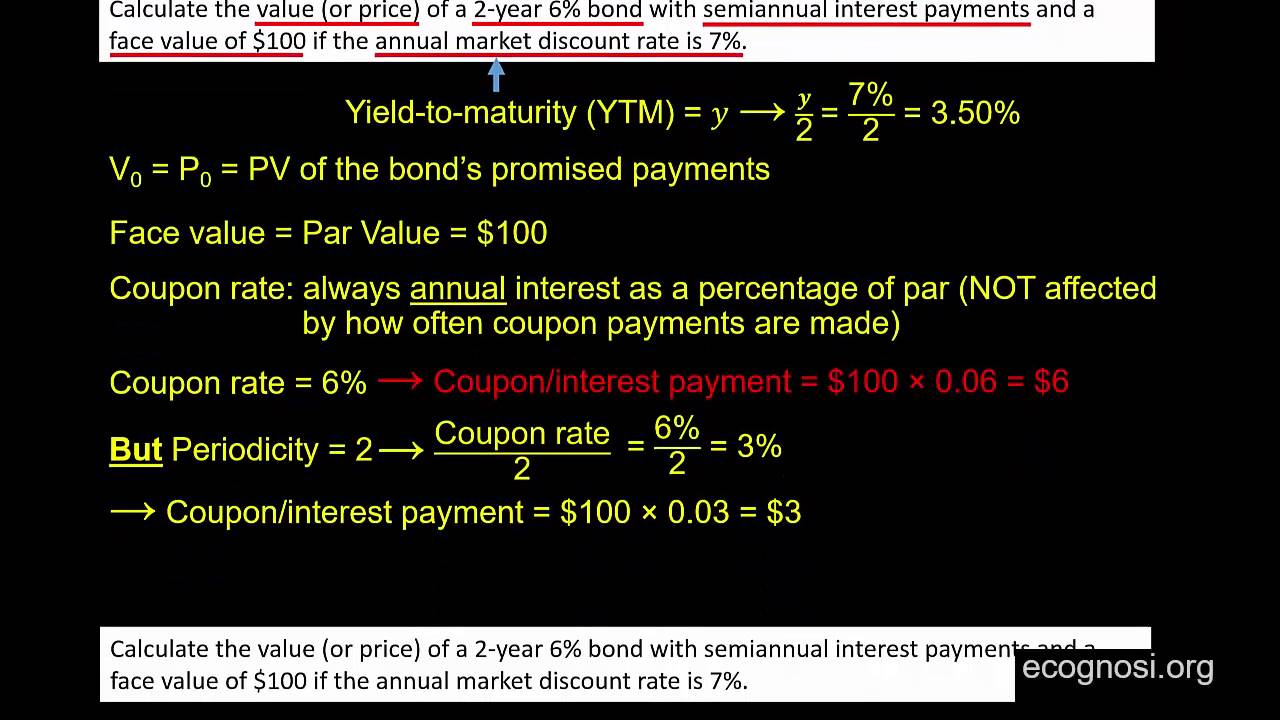

› finance › bond-priceBond Price Calculator | Formula | Chart Jun 20, 2022 · Calculate the coupon per period. To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50 ... › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... vindeep.com › Calculators › RateConverterCalcInterest Rate Converter | Convert annual to monthly, semi ... You can also use this tool to compare two or more interest rates having different interest payment frequencies. For example, if you need to compare an interest rate of 12% p.a., payable monthly with an interest rate of 12.50% p.a., payable annually to find which one is expensive in terms of effective cost, convert the former into annual one or the latter into monthly one using this tool - to ... T2023-S$ Temasek Bond - Temasek Coupon Rate: Fixed rate of 2.70% per year, payable every six months. Tenor: 5 years. Issue Ratings: Aaa by Moody's and AAA by S&P : ... Semi-annual: 25 October 2023: Glossary. Coupon Payment Date being the expected date the coupon payment is remitted to the bondholder's respective bank account;

10% Off Boscov's Coupon - September 2022 | U.S. News Deals Boscov's Coupons for September 2022 | Savings up to 75% with 83 Boscov's promo codes | USNews Deals. ... Rate the deals - Boscov's. consumer ratings with an average of out of 5 stars. Top Boscov's deal. ... Semi Annual Curtain sale at Boscov's: All curtains at $9.99

ICE BofA US High Yield Index Semi-Annual Yield to Worst Graph and download economic data for ICE BofA US High Yield Index Semi-Annual Yield to Worst (BAMLH0A0HYM2SYTW) from 1996-12-31 to 2022-09-27 about YTW, yield, interest rate, interest, rate, and USA. ICE BofA US High Yield Index Semi-Annual Yield to Worst. ... The standard US convention for this series is to use semi-annual coupon payments ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

50% Off - Soma Promo Code - September 2022 - CNET Coupons These Soma coupons have been marked expired, but feel free to try them out. Soma Offer - Up to 70% off in the Semi Annual Sale More Details 50% COUPON Grab 50% off Show coupon More Details Limited...

40% PUMA Discount | September 2022 - Boston.com Coupons

Yield to Maturity Calculator | YTM | InvestingAnswers For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and matures in 5 years. You would enter: "1,000" as the face value "8" as the annual coupon rate "5" as the years to maturity "2" as the coupon payments per year, and "900" as the current bond price.

$75 Macy's Discount | September 2022

Interest Rate Converter | Convert annual to monthly, semi annual … You can also use this tool to compare two or more interest rates having different interest payment frequencies. For example, if you need to compare an interest rate of 12% p.a., payable monthly with an interest rate of 12.50% p.a., payable annually to find which one is expensive in terms of effective cost, convert the former into annual one or the latter into monthly one using this tool - …

HostDare - Promotional Premium China Optimized KVM VPS - VN Coupon Coupon code 4ZU5EMXV3H,15% ... Coupon code 15OFFHD ,15% recurring discount in all our CSSD China optimized NVMe SSD plans valid for quarterly,semi-annual,annual, biannual,triennial payment terms . Coupon expiry date: 10/15/2022 (15th October) ... Rate this post. Facebook Twitter Email. TAGS: ...

Coupon Rate Calculator | Bond Coupon 15.07.2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

iFAST Central Coupon Type 7.25 Annual Coupon Rate (%) - Reference Rate Semi-Annually Annual Coupon Frequency First Lien Seniority SGX Exchange Listed - Modified Duration (Years) Bond Performance Performance Chart Price Chart Yield Chart 3 Years Since Inception

Axel Merk Blog | TIPS - A Misunderstood Inflation Hedge | Talkmarkets The below chart shows the inflation-adjusted principal and the coupon payments on a $1,000,000 face value TIPS bond that matured in July 2022. The bond paid a 0.125% coupon semi-annually. (Click on image to enlarge) Simplified Examples—Illustration of Hypothetical TIPS

mm2 Asia to move forward with $54m bond deal for cinema business The exchangeable bonds bear a coupon rate of 5 per cent per annum, payable on a semi-annual basis, with a tenure of three years. Should the bond holder elect to exchange at the end of the second...

30% Off Skechers Coupon, Promo Codes - Sept. 2022 - Giving Assistant 25% OFF. 25% off your first order with Skechers email signup. Limited Time. 20% OFF. Get Up To 20% Off Orders For Plus Members Only. Limited Time. 15% OFF. Get Up To 15% Off $50+ Sitewide For Plus Members. Limited Time.

Corporate America Credit Union - All Rates Coupon Rate: 4.70%: Settlement Date: 9/30/2022: Maturity Date: 9/30/2024: Minimum Investment: $100,000: Call Schedule; Initial Call Protection: 6 Months: Subsequent Calls: Quarterly: ... You can now access SimpliCD rates and make purchases directly through SSO. You can also call our Member Investment Group at 800.292.6242 ext 160 or 163, ...

Yield to Call Calculator | Calculating YTC | InvestingAnswers For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and is callable in 5 years at 103% of face value. Using our YTC calculator, enter: "1,000" as the face value "8" as the annual coupon rate "5" as the years to call "2" as the coupon payments per year "103" as the call premium, and

$20 Off & 60% Sale ~ Dick's Sporting Goods Promo Code - wikiHow Coupons $20 Coupon Receive $20 off with Text Alert Sign Up with this Discount Code Get coupon Expires on Dec 31, 2022 TERMS & CONDITIONS 60% Up to 60% off Fan Gear at Dick's Sporting Goods Expires on Dec 31, 2022 TERMS & CONDITIONS 10% Coupon Get 10% off with Newsletter Sign Up with this Promo Code at Dick's Sporting Goods Get coupon

$75 Off Macy's Promo Code - September 2022 - wikiHow - wikiHow Coupons 30-50% off in the Semi-Annual Lingerie Sale No expiration date listed TERMS & CONDITIONS Deal 25-70% off Clearance No expiration date listed TERMS & CONDITIONS Deal 20-50% off Summer Must-Haves No expiration date listed TERMS & CONDITIONS 60% Deal Up to 60% off Select Luggage Expires on Aug 31, 2022 TERMS & CONDITIONS 40% Deal

› Calculate-Annual-Interest-on-Bonds3 Ways to Calculate Annual Interest on Bonds - wikiHow Mar 29, 2019 · To calculate the annual interest, you need to know the coupon rate and the price of the bond. For example, Company QRS issues 5-year, $500,000, 10 percent bonds, with interest paid semi-annually. The market interest rate is 10 percent, so the bond is issued at par.

XCCC - BondBloxx® ETF Semi-Annual Report; Carefully consider the Funds' investment objectives, risks, charges, and expenses before investing. This and other information can be found in the Funds' prospectus or, ... Average Coupon: The average coupon rate of the underlying bonds in the fund, ...

ASICS Coupon Codes 2022 (60% discount) - October Promo … Score up to 60% off with Asics Semi-Annual Sale SEMI-ANNUAL SALE! Get up to 60% off on select models through 7/31. Shop deals starting at $39.95 for Running and Sportstyle models for men, women, and kids. GEL-Kayano, GEL-Venture, GEL-Lyte and MORE . NEEDED. Show Coupon Code. in ASICS coupons. $5. OFF EXPIRED. One Menmbers: Extra $5 Off With Gel …

Bond Price Calculator | Formula | Chart 20.06.2022 · Calculate the coupon per period. To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50 ...

Invest in G-SEC STRIPS India - Bondsindia.com semi annual. For greater than 6 months. Price arrived at by discounting the single cash flow of the G-STRIP at the agreed yield. Price expressed as Discounted Value per Rs. 100 Face Value. Example. Let’s understand the pricing better with the help of an example. The face value of a G-Strip Bond is Rs 1000. The bond bears a coupon rate of 9% with coupon payments being …

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Example 2: Semi-annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? 5*2 = $781.20. The price that John will pay for the bond today is $781.20. Reinvestment Risk and ...

› terms › bWhat Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Interest Rate Futures Products - National Stock Exchange India G-Sec Futures. The G-Sec Futures contracts are available for trading based on Government of India (GOI) security of face value 100 with semi-annual coupon and residual maturity between 4 and 15 years on the day of expiry of IRF contract, as decided by stock exchanges in consultation with FIMMDA. Three Serial monthly contracts followed by three ...

TIPS - A misunderstood inflation hedge The coupon rate is fixed, but the dollar value of the coupon payment adjusts with changes in the price level of consumer goods and services. The below chart shows the inflation-adjusted principal...

ARDC: An Attractive Income Profile For This 9.9%-Yielding Credit CEF We expect the next semi-annual period to see a significant net income boost. Systematic Income ARDC is likely thinking along the same lines as it raised the fund's distribution 5% in August to...

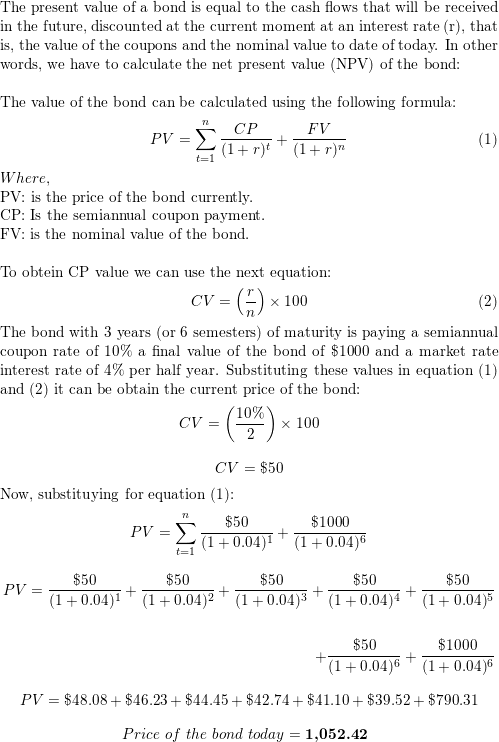

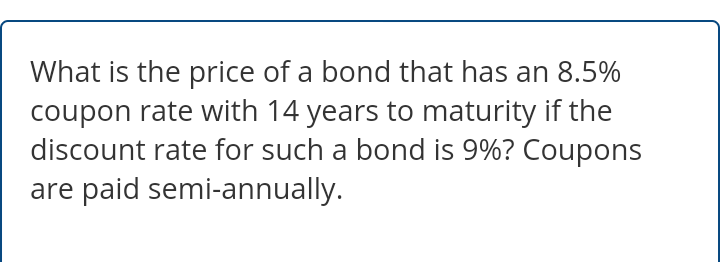

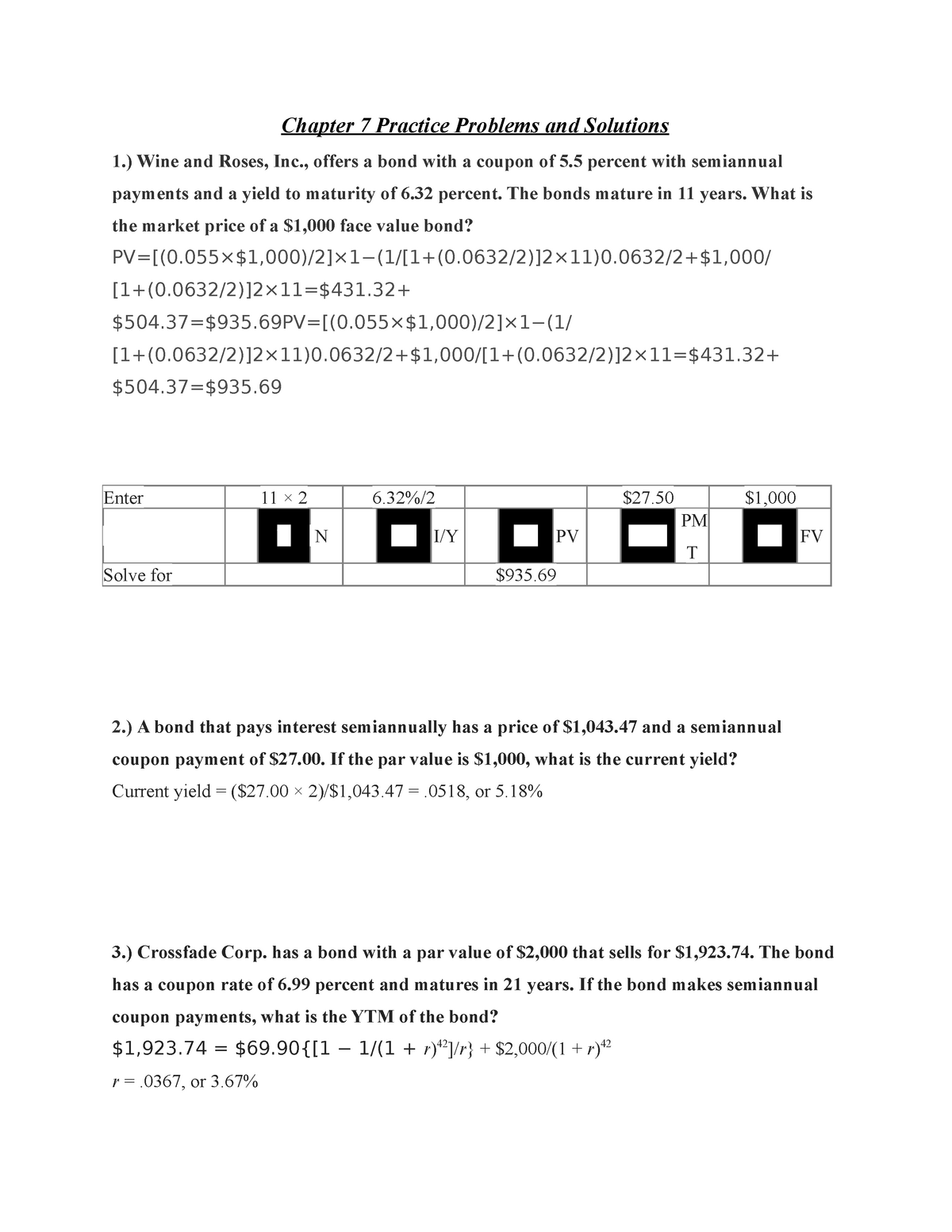

Bond Pricing Formula | How to Calculate Bond Price? | Examples Let us take an example of a bond with semi-annual coupon payments. Let us assume a company ABC Ltd has issued a bond having the face value of $100,000 carrying a coupon rate of 8% to be paid semi-annually and maturing in 5 years. The prevailing market rate of interest is 7%. Hence, the price of the bond calculation using the above formula as, Since the coupon rate is …

South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.885% yield. 10 Years vs 2 Years bond spread is 368.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 6.25% (last modification in September 2022). The South Africa credit rating is BB-, according to Standard & Poor's agency.

mm2 Asia to move forward with S$54m bond deal for cinema business The exchangeable bonds bear a coupon rate of 5 per cent per annum, payable on a semi-annual basis, with a tenure of 3 years. Should the bondholder elect to exchange at the end of the second year, the bondholder will receive shares of mm Connect constituting 60 per cent of the share capital, at a base valuation of S$90 million.

Post a Comment for "43 coupon rate semi annual"