39 coupon paying bond formula

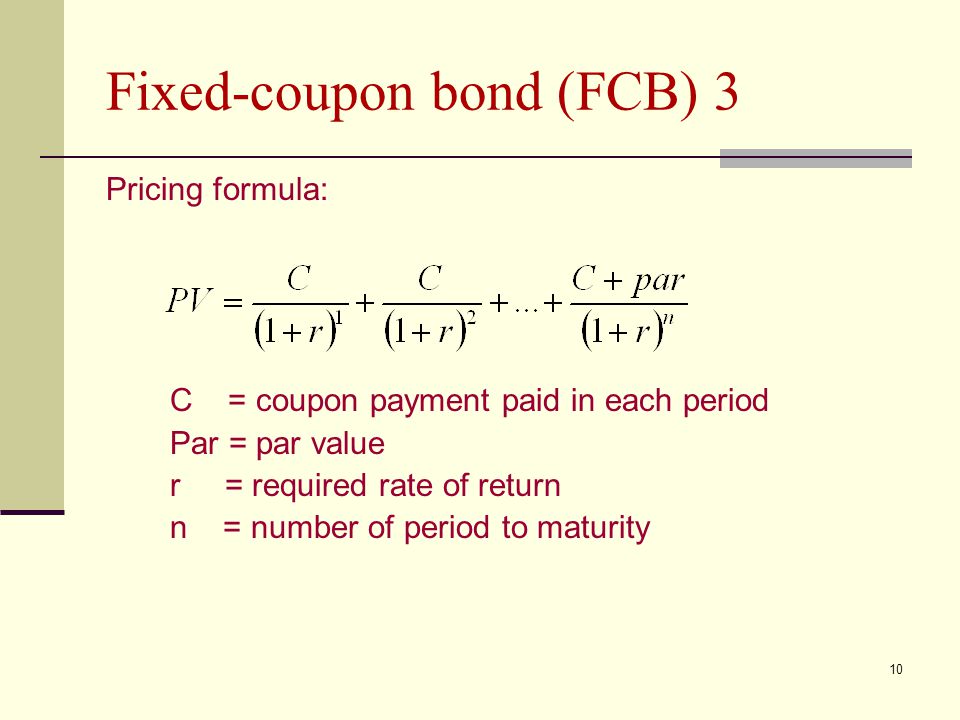

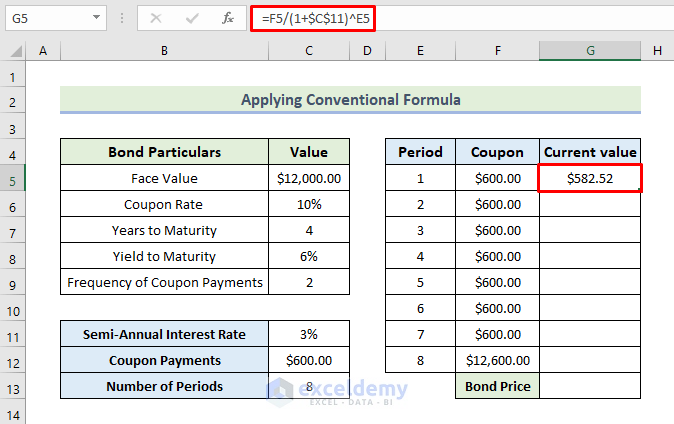

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Calculate the Value of a Coupon Paying Bond - Finance Train Par Value = $1,000. Yield = 13% annual (13/2 =6.5% semi-annual) Coupon = 12% with semi-annual payment of $60. Maturity = 1 year. The value of the bond is calculated as follows: Note that the coupon is paid semi-annually, i.e., $60 per 6 months. The discounting is also done semi-annually. The general bond pricing formula for all bonds can be ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

Coupon paying bond formula

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell A3, enter the formula "=A1*A2" to yield the total annual coupon payment. Moving down the spreadsheet, enter the par value of your bond in cell B1. Most bonds have par values of $100 or ... Coupon Payment | Definition, Formula, Calculator & Example Formula. Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator. Bond Yield Formula | Calculator (Example with Excel Template) - EDUCBA Bond Price = ∑ [Cash flowt / (1+YTM)t] The formula for a bond's current yield can be derived by using the following steps: Step 1: Firstly, determine the potential coupon payment to be generated in the next one year. Step 2: Next, figure out the current market price of the bond. Step 3: Finally, the formula for current yield can be derived ...

Coupon paying bond formula. Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Here we must understand that this calculation completely depends on the annual coupon and bond price. It completely ignores the time value of money, frequency of payment, and amount value at the time of maturity. Step 1: Calculation of the coupon payment Annual Payment. =$1000*5%. Coupon Bond: Definition, How They Work, Example, and Use Today Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset For example: ABC Corp. releases a bond worth $1,000 at issue. Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond ... Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity.

What is the discount factor formula for a coupon paying bond? Answer (1 of 4): You can use different factors depending on what you are discounting from and what you are trying to achieve. Discount factors can be used to price the cashflows of a bond over its maturity from a curve rather than a constant discount factor from a gross redemption yield to matur... How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Depending on the particulars of a bond, you might pay more or less than its face value when you buy it, known as buying bonds at a premium or at a discount. The price you "should" pay is based on the required rate of return, which is a technical term that discounts the semiannual and face-value payments to present-day values. Par Bond - Overview, Bond Pricing Formula, Example The present value formula is used to price a bond: Where: C equals the coupon payment; n equals the number of payment periods; i equals the interest rate; and; FV equals the value at maturity. Face value is also known as par value. Example of a Par Bond. A bond with a face value of $100 and a maturity of three years comes with a coupon rate of ... What Is a Bond Coupon, and How Is It Calculated? - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow 1. Use the coupon rate and the face value to calculate the annual payment. If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment ... Coupon Payment Bond Formula - uslegalforms.com Coupon Rate Formula — The formula to calculate a bond's coupon rate is very straightforward, as detailed below. Using the bond valuation formulas as just completed above, the value of bond B with a yield of. Show more. Bond Formula | How to Calculate a Bond | Examples with Excel Template Bond Formula - Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? What is Coupon Bond Formula? The term " coupon bond Coupon Bond Coupon bonds pay fixed interest at a predetermined frequency from the bond's issue date to the bond's maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate. read more " refers to bonds that pay coupons which is a nominal percentage of the par value or ...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-Coupon Bond Formula. Zero-Coupon Bond YTM Example. YTM Over Time. ... Instead of paying coupons, z-bonds are typically issued at a discount in the market and then mature to their face value ...

Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

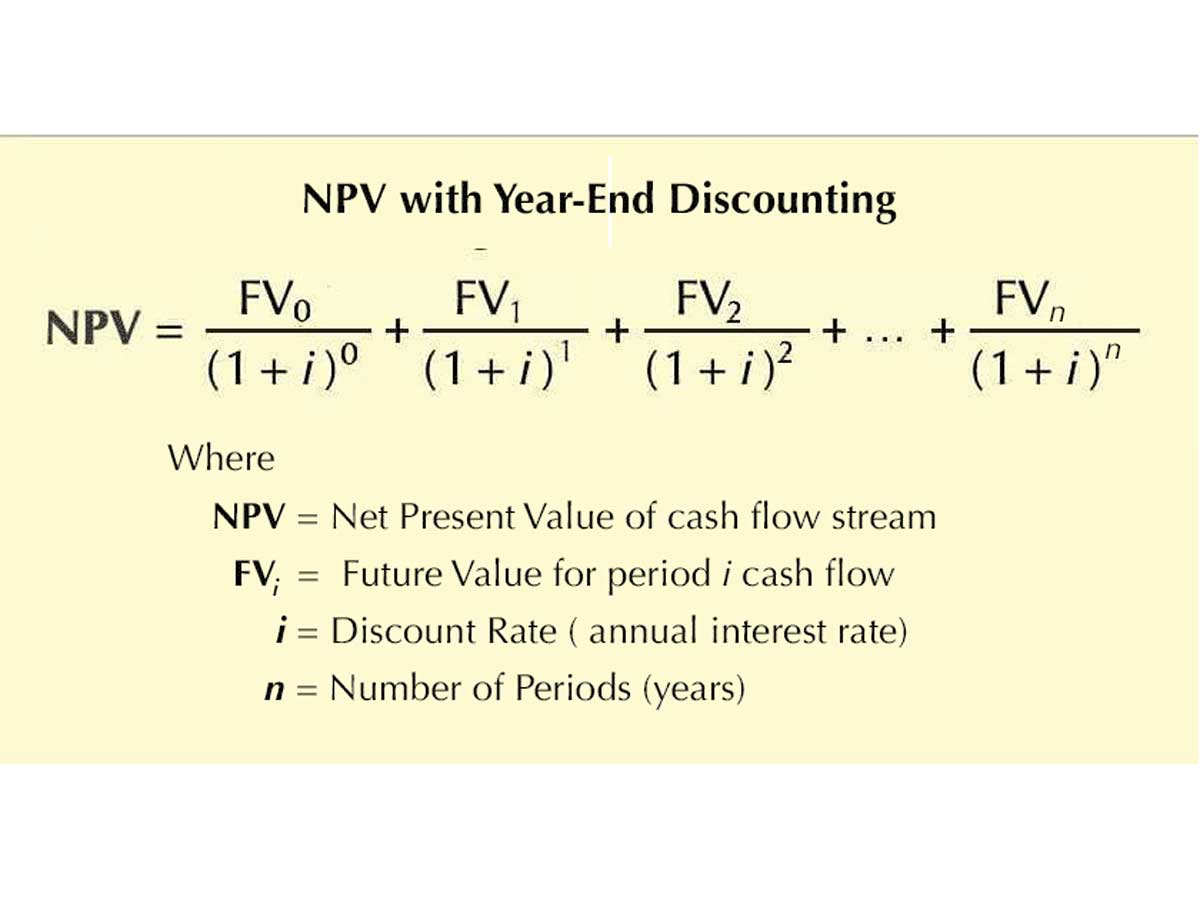

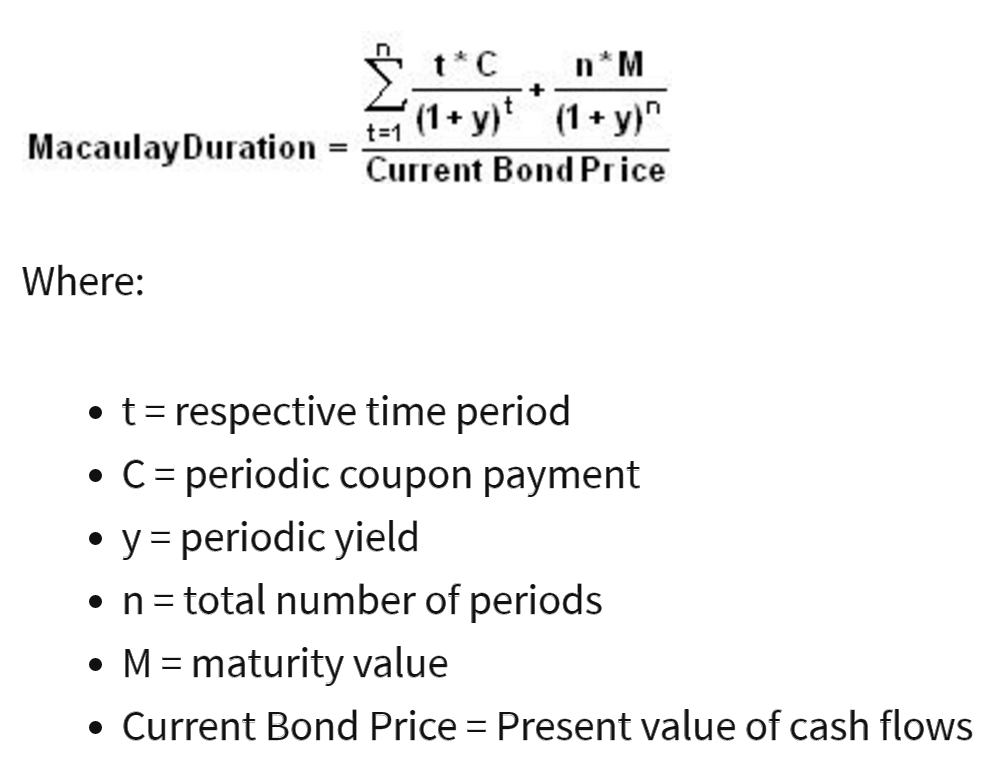

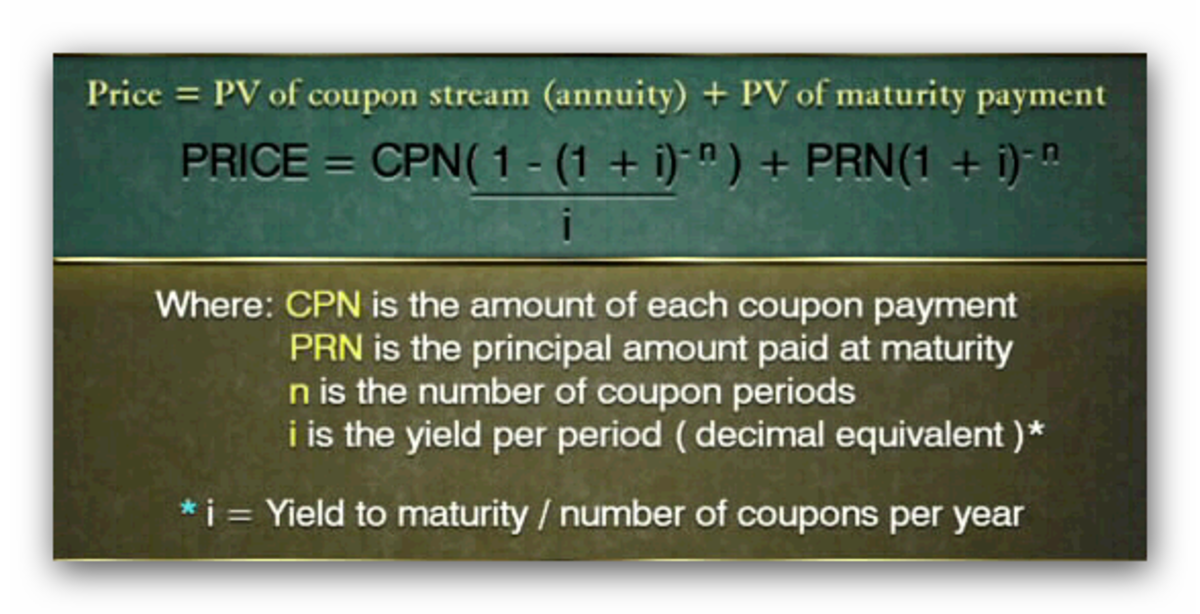

Bond Pricing Formula | How to Calculate Bond Price? | Examples The formula for bond pricing is the calculation of the present value of the probable future cash flows, which comprises the coupon payments and the par value, which is the redemption amount on maturity. The rate of interest used to discount the future cash flows is known as the yield to maturity (YTM.) Bond Price = ∑i=1n C/ (1+r)n + F/ (1+r)n ...

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates, etc, Please provide us with an attribution link.

Zero-Coupon Bonds: Characteristics and Calculation Example Zero-Coupon Bond Yield-to-Maturity (YTM) Formula. The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond's cash flows equal to the current market price.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as ...

Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.. You can quickly calculate the coupon payment for each payment period using the coupon payment formula:

Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond.

Bond Yield Formula | Calculator (Example with Excel Template) - EDUCBA Bond Price = ∑ [Cash flowt / (1+YTM)t] The formula for a bond's current yield can be derived by using the following steps: Step 1: Firstly, determine the potential coupon payment to be generated in the next one year. Step 2: Next, figure out the current market price of the bond. Step 3: Finally, the formula for current yield can be derived ...

Coupon Payment | Definition, Formula, Calculator & Example Formula. Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator.

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell A3, enter the formula "=A1*A2" to yield the total annual coupon payment. Moving down the spreadsheet, enter the par value of your bond in cell B1. Most bonds have par values of $100 or ...

Post a Comment for "39 coupon paying bond formula"