41 zero coupon bonds advantages

Corporate Bonds: Advantages and Disadvantages - Investopedia 31.01.2022 · Bonds that have a zero-coupon rate do not make any interest payments. Instead, governments, government agencies, and companies issue bonds with zero-coupon rates at a discount to their par value ... EzineArticles Submission - Submit Your Best Quality Original … EzineArticles.com allows expert authors in hundreds of niche fields to get massive levels of exposure in exchange for the submission of their quality original articles.

Overwatch 2 reaches 25 million players, tripling Overwatch 1 daily ... 14.10.2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

Zero coupon bonds advantages

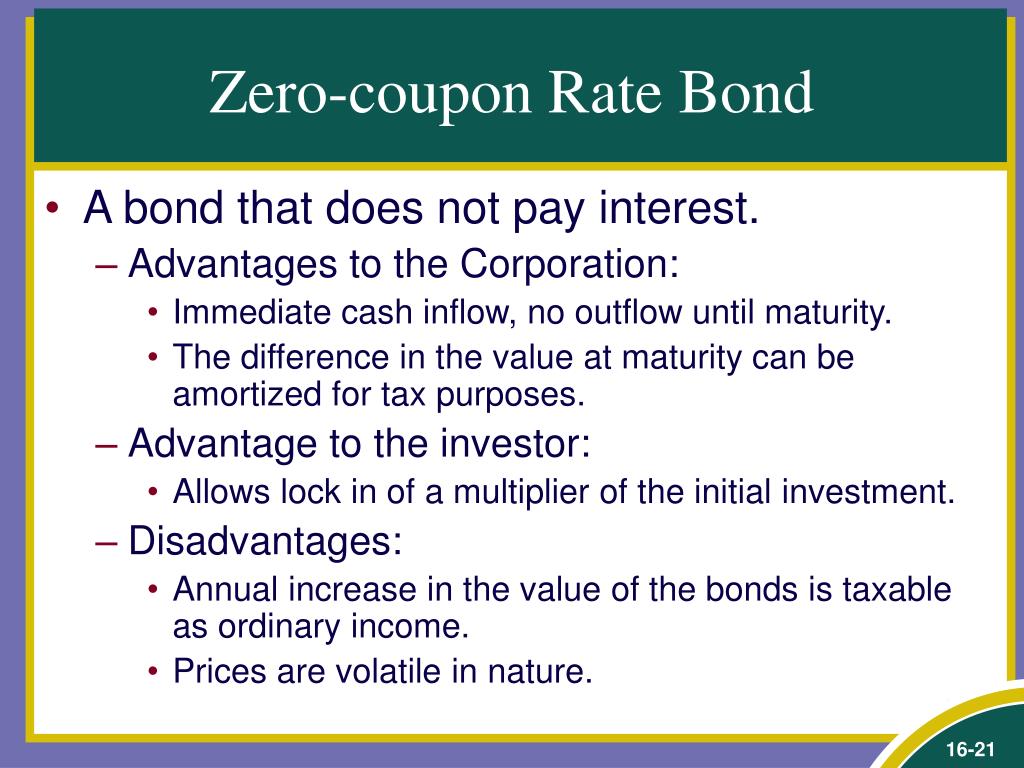

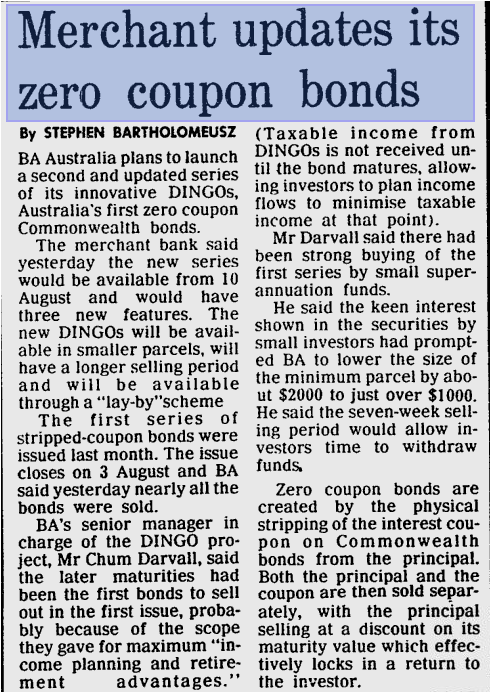

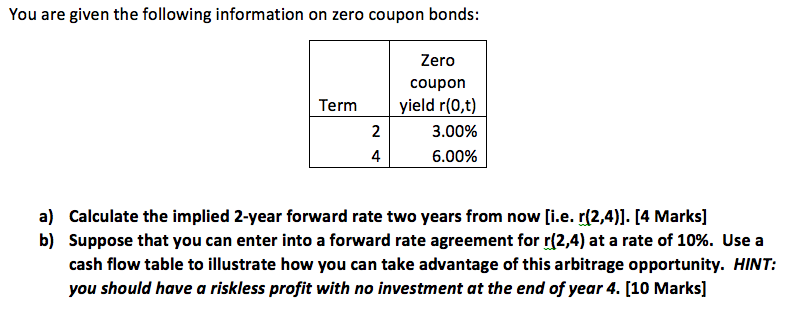

Advantages and Risks of Zero Coupon Treasury Bonds 31.01.2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival. Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

Zero coupon bonds advantages. Zero-Coupon Bonds - Accounting Hub Advantages of Zero-Coupon Bonds. Zero-coupon bonds offer several benefits to issuers and investors. These bonds are less volatile and offer predictable returns to investors. Investors are assured of fixed income at maturity, so it eliminates the reinvestment risk as there are no periodic repayments. These bonds require a low initial investment. Achiever Papers - We help students improve their academic standing What advantages do you get from our Achiever Papers' services? All our academic papers are written from scratch. All our clients are privileged to have all their academic papers written from scratch. These papers are also written according to your lecturer’s instructions and thus minimizing any chances of plagiarism. We have highly qualified writers from all over the world. … The One-Minute Guide to Zero Coupon Bonds | FINRA.org This feature offers protection from the risk that you will have to settle for a lower rate of return if your bond is called, you receive cash, and you need to reinvest it (this is known as reinvestment risk). That said, zero-coupon bonds carry various types of risk. Unbanked American households hit record low numbers in 2021 25.10.2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ...

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww No regular income: The Zero Coupon bond provides in a lump sum; therefore, it prevents a regular cash flow. This bond will not benefit investors with the requirement of regular cash. Interest Rate Risk: Interest rates of this bond can decline over time due to fluctuation in the market. What is a zero-coupon bond? What are the advantages and risks? What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival. The Basics of Bonds - Investopedia 31.07.2022 · Because bonds pay a steady interest stream, called the coupon, owners of bonds have to pay regular income taxes on the funds received. For this reason, bonds are best kept in a tax sheltered ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. This makes typical bonds a great source of income, though it limits their capital appreciation if & when bond yields fall (as they often do during recessions, deflation & strong disinflation). Bond yields & price move inversely. Thus if interest rates fall, any outstanding bond which pays an …

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Advantages #1 - Predictability of Returns This offers predetermined returns if held till maturity, which makes them a desirable choice among investors with long term goals or for those intending assured returns and doesn't intend to handle any type of Volatility usually associated with other types of Financial Instruments such as Equities, etc. The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates. Mortgage-backed security - Wikipedia Covered bonds were first created in 19th-century Germany when Frankfurter Hypo began issuing mortgage covered bonds. The market has been regulated since the creation of a law governing the securities in Germany in 1900. The key difference between covered bonds and mortgage-backed or asset-backed securities is that banks that make loans and package them into … Zero-Coupon Bonds: Pros and Cons - Management Study Guide Some of the advantages of these bonds have been mentioned below: Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

Zero Coupon Bonds_1 | Investing Post Advantages of Purchasing Zero Coupon Bonds. U.S. Treasury bonds offer a stable and secure investment because they are federally insured and pay a fixed rate over time. They are sold at a lower price than the face value which is paid to the holder at maturity. Another safe investment option includes U.S. Savings bonds which are backed by the ...

Finance - Wikipedia Finance is the study and discipline of money, currency and capital assets.It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly …

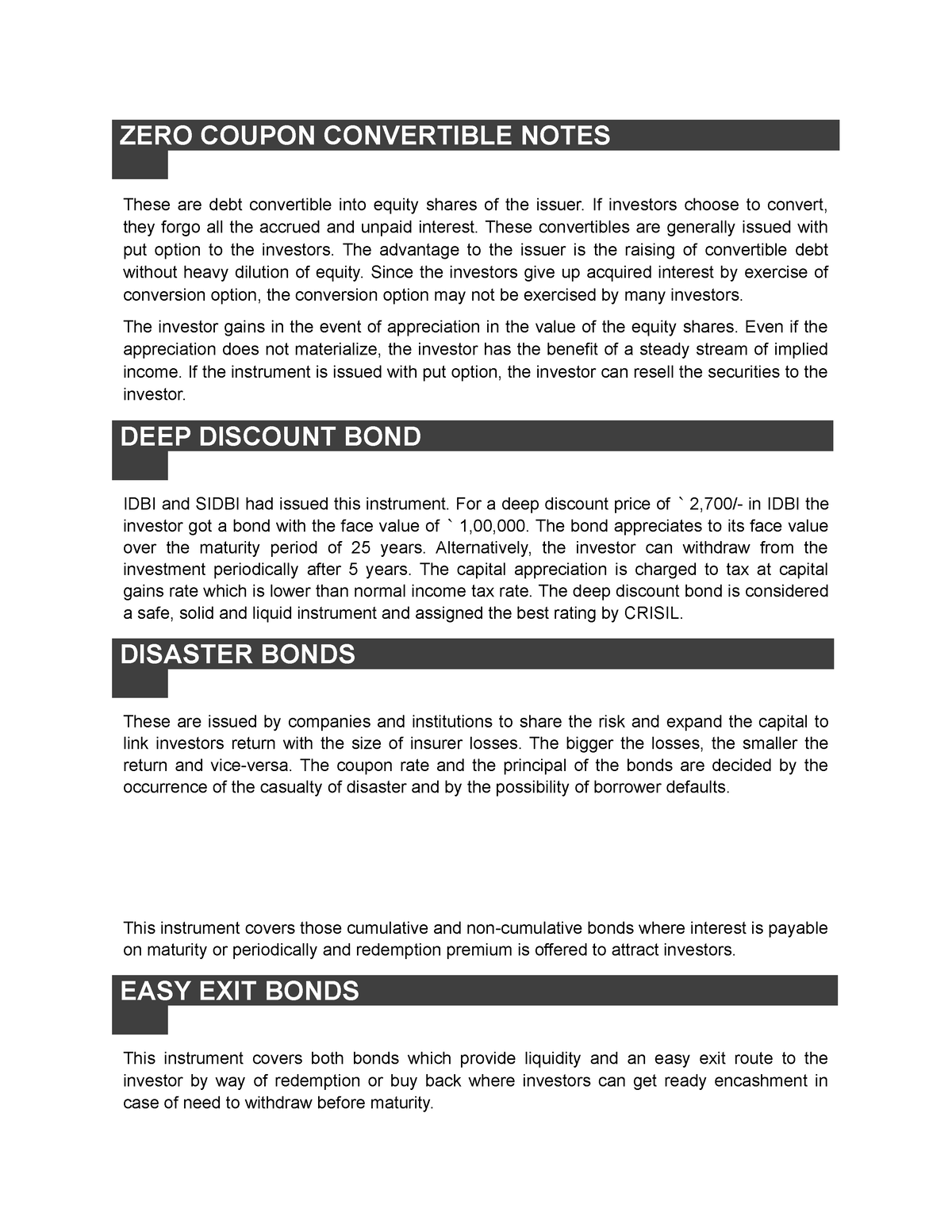

What are Zero Coupon Bonds? | Features, Advantages, Disadvatages Advantages of Zero Coupon Bonds Long-Term in Nature Conservation of Cash No Reinvestment Risk Disadvantages of Zero Coupon Bonds Taxability Loss of Interest Highly Fluctuation Market Prices High Repayment Risk Return of Investors

Advantages and Disadvantages of Bonds | Boundless Finance - Course Hero Zero coupon bonds: A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. ... Advantages of Bonds Bonds have a clear advantage over other securities. The volatility of bonds (especially short and medium dated bonds) is ...

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

› en-us › investments25+ Year Zero Coupon U.S. Treasury Index Exchange ... - PIMCO Sep 30, 2022 · Aims to achieve the benefits of exposure to a long U.S. Treasury fund. The fund aims to achieve, before fees and expenses, the yield and duration exposure inherent in a long U.S. Treasury fund.

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

Advantages and Risks of Zero Coupon Treasury Bonds 31.01.2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

Post a Comment for "41 zero coupon bonds advantages"