42 coupon rate and yield

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be -. Coupon Rate = 5-Year Treasury Yield + .05%. So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5 ... Economic growth - Wikipedia The rule of 72, a mathematical result, states that if something grows at the rate of x% per year, then its level will double every 72/x years. For example, a growth rate of 2.5% per annum leads to a doubling of the GDP within 28.8 years, whilst a growth rate of 8% per year leads to a doubling of GDP within nine years.

TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch Treasury yields jump, led by 1- through 3-year rates, after revised third-quarter GDP figures; 2-year rate hits 4.53% Nov. 30, 2022 at 9:29 a.m. ET by MarketWatch 2-year Treasury yield ticks up 4 ...

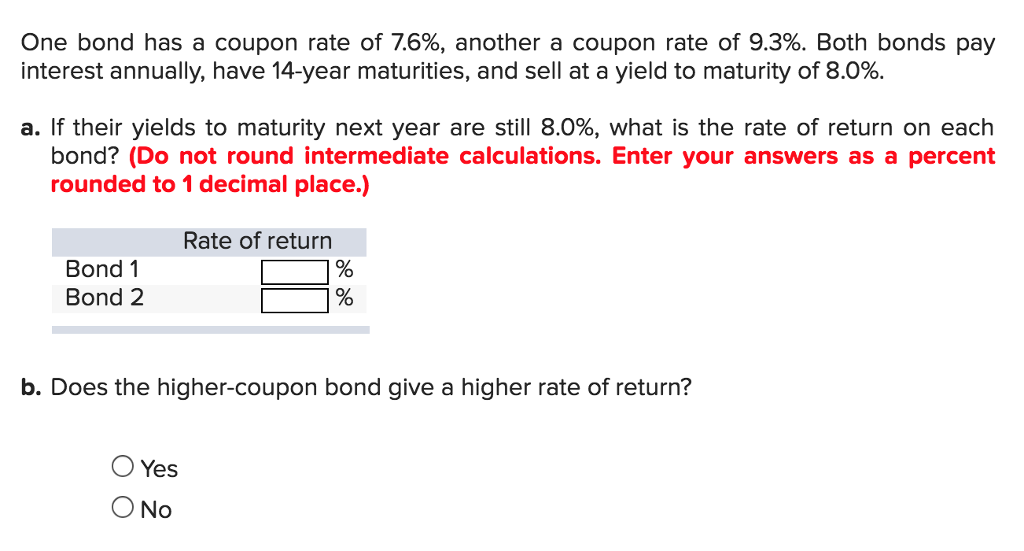

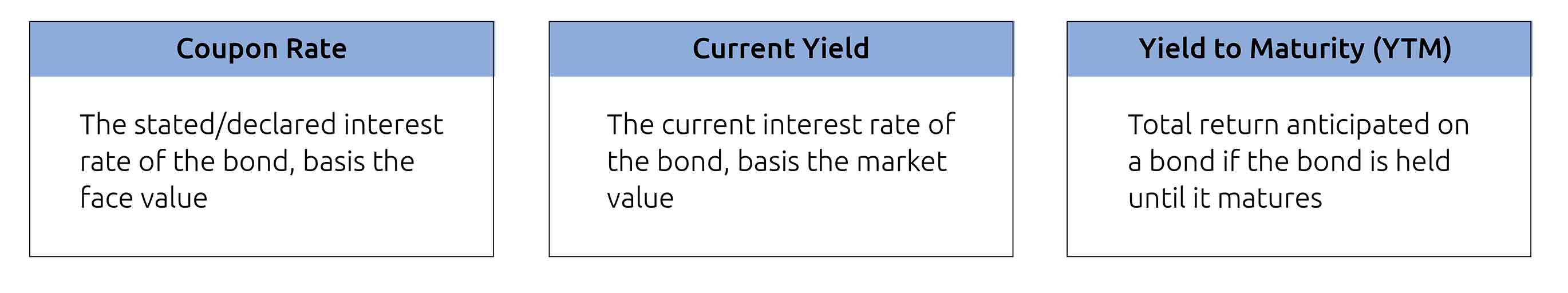

Coupon rate and yield

When is a bond's coupon rate and yield to maturity the same? - Investopedia Vikki Velasquez. A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond ... What is the relationship between coupon rate required yield and price ... When is the yield to maturity equals the coupon rate? When a Bond's Yield to Maturity Equals Its Coupon Rate. If a bond is purchased at par , its yield to maturity is thus equal to its coupon rate, because the initial investment is offset entirely by repayment of the bond at maturity, leaving only the fixed coupon payments as profit. Nov 18 2019 Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, and ...

Coupon rate and yield. Business News, Personal Finance and Money News - ABC News Nov 10, 2022 · Find the latest business news on Wall Street, jobs and the economy, the housing market, personal finance and money investments and much more on ABC News What Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · Later, Investor B buys the bond for $900 as the market has heated up and a safe instrument has lost value. Coupon and yield rates are: Coupon Rate: 10%. This does not change. Investor A Yield Rate: 9%. The investor paid $1,100 for a bond that returns only $100 per year, making their yield on the bond lower than its coupon rate. Investor B Yield ... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Difference Between a Coupon Rate and a Yield Rate? The yield rate takes into account the interest rate paid on the bond and any capital gains or losses that may occur when the bond is sold. The difference between a coupon rate and a yield rate. Regarding bonds, the coupon rate is the interest rate the issuer agrees to pay the holder for the bond's life. The yield is the return rate that an ...

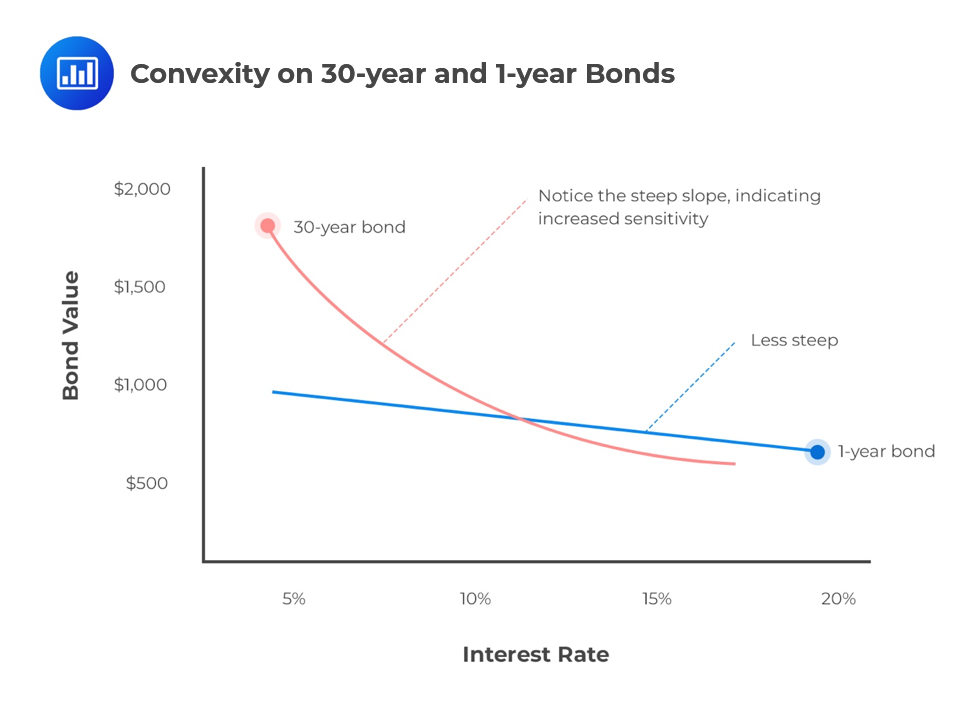

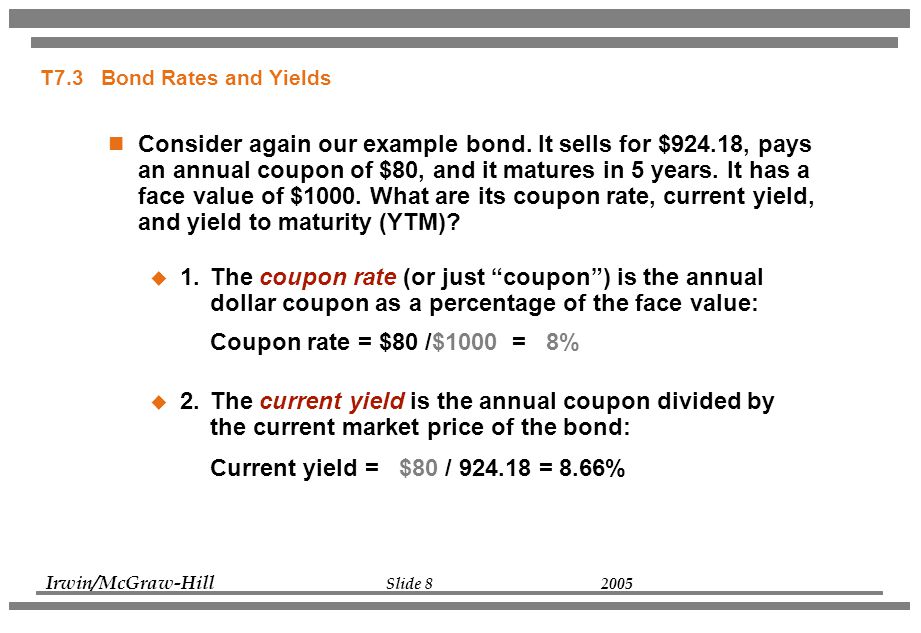

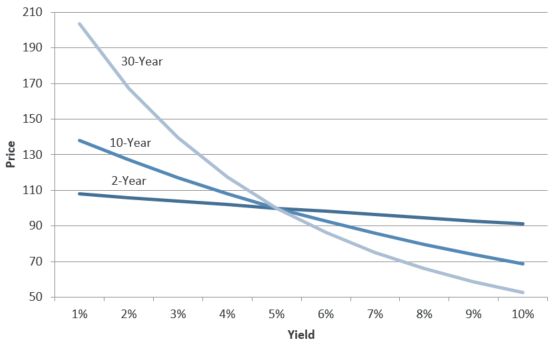

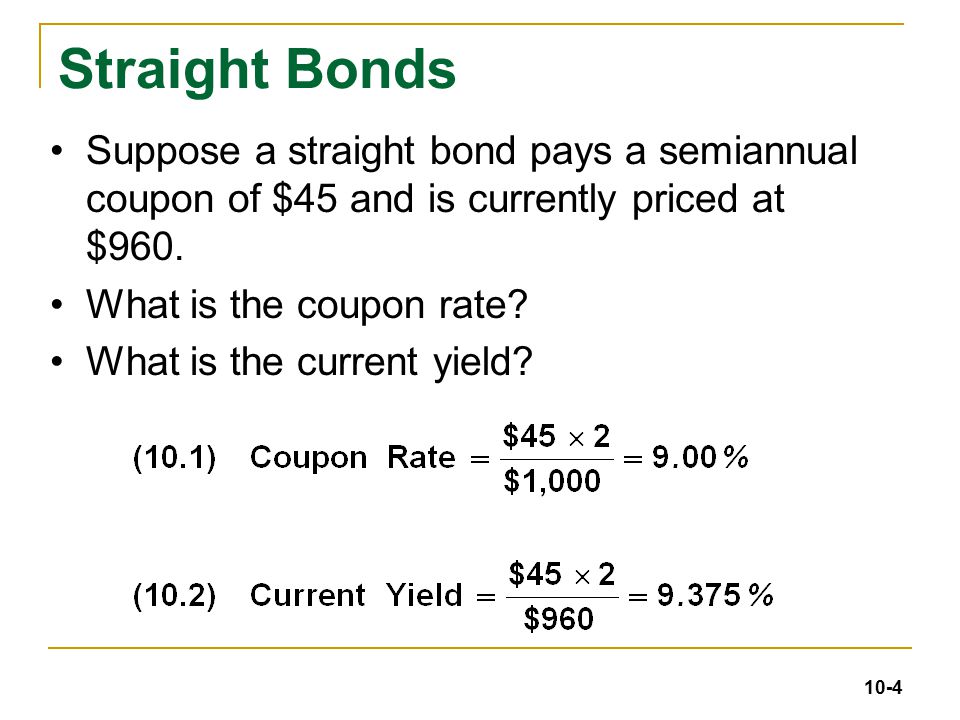

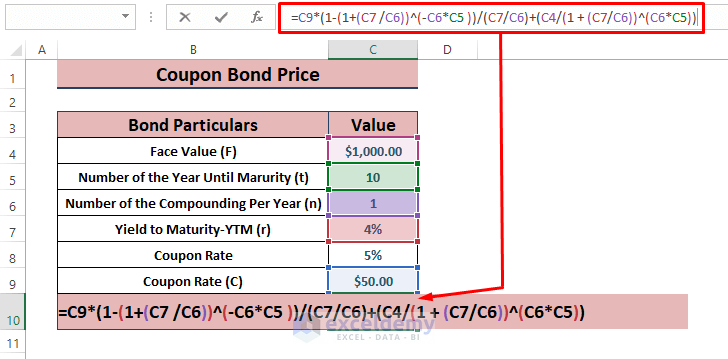

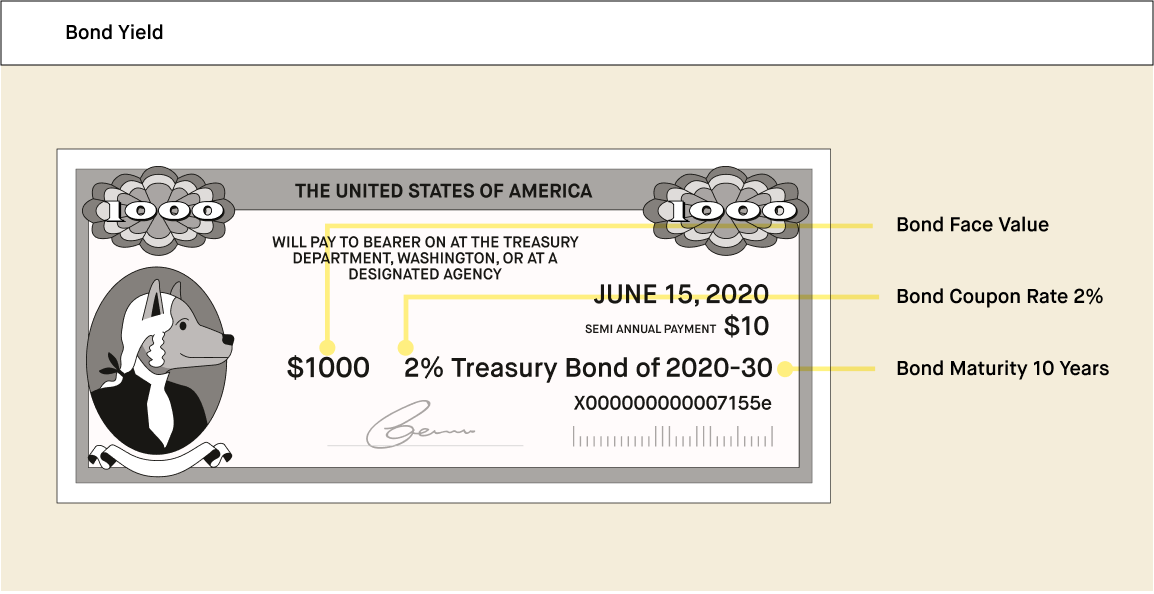

What The Heck Is An Inverted Yield Curve? And Why Does It ... Sep 26, 2022 · The yield to maturity is the rate of return of all the cashflow earned from a bond, including coupon and principal repayment. The yield to maturity is inversely proportional to the bond price. If ... Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security. Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ... Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ...

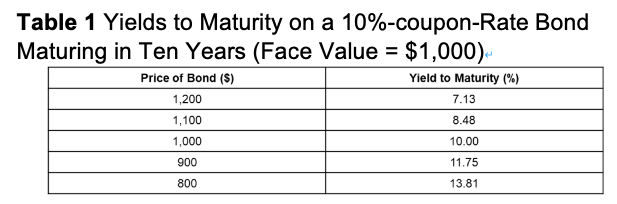

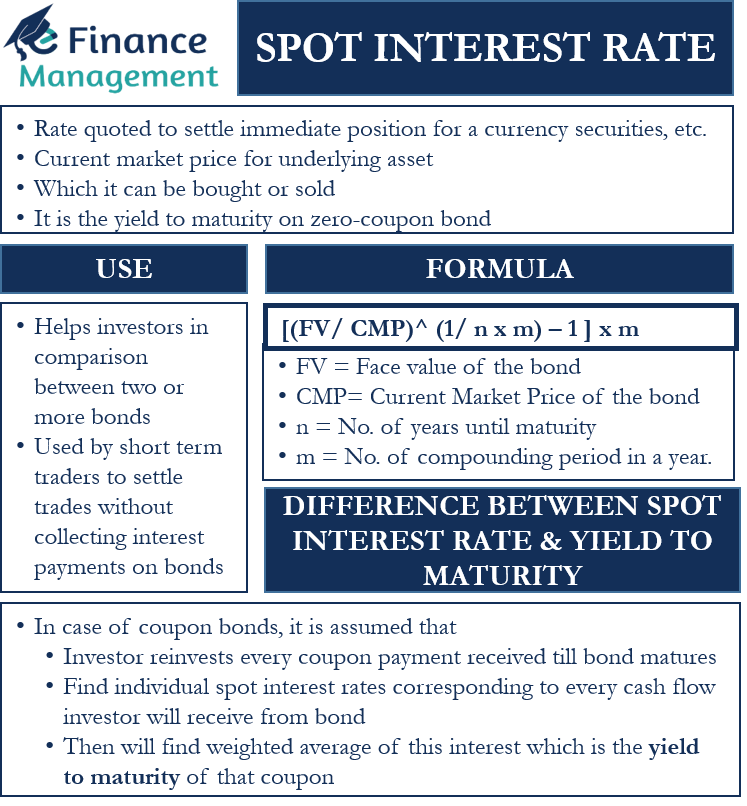

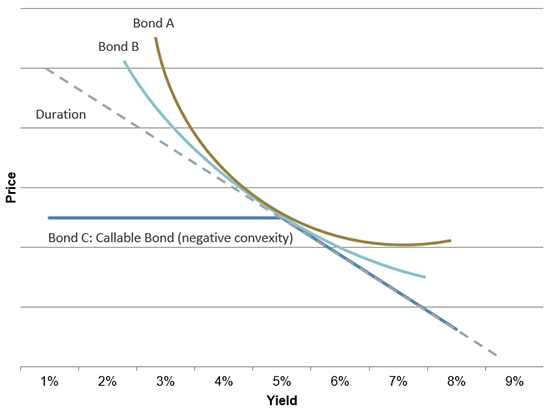

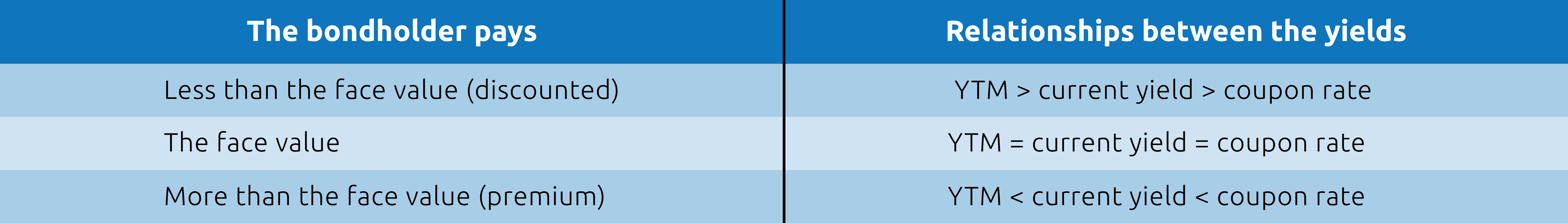

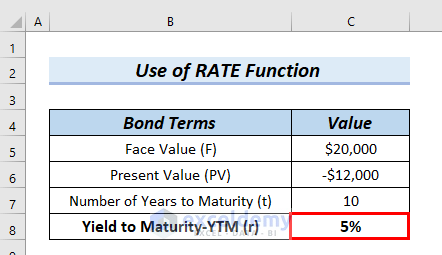

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Here's another example that clearly ... Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet Unlike a coupon which is static, the yield is a dynamic value that accounts for the current price of the bond. Take a bond with a face value of $100, which we'll call XYZ bond. At inception, the bond's yield is equal to its coupon, because the bond price is at par, or at 100% of the face value. So at issuance it has a 5% coupon and a 5% yield. Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Difference Between Coupon Rate and Yield to Maturity The coupon rate remains the same throughout the bond tenure year, while Yield to Maturity (YTM) changes with the period left for the bond maturation and also on the current market value of the bond. The coupon rate represents the interest payment rates that are to be received annually by the bond receiver.

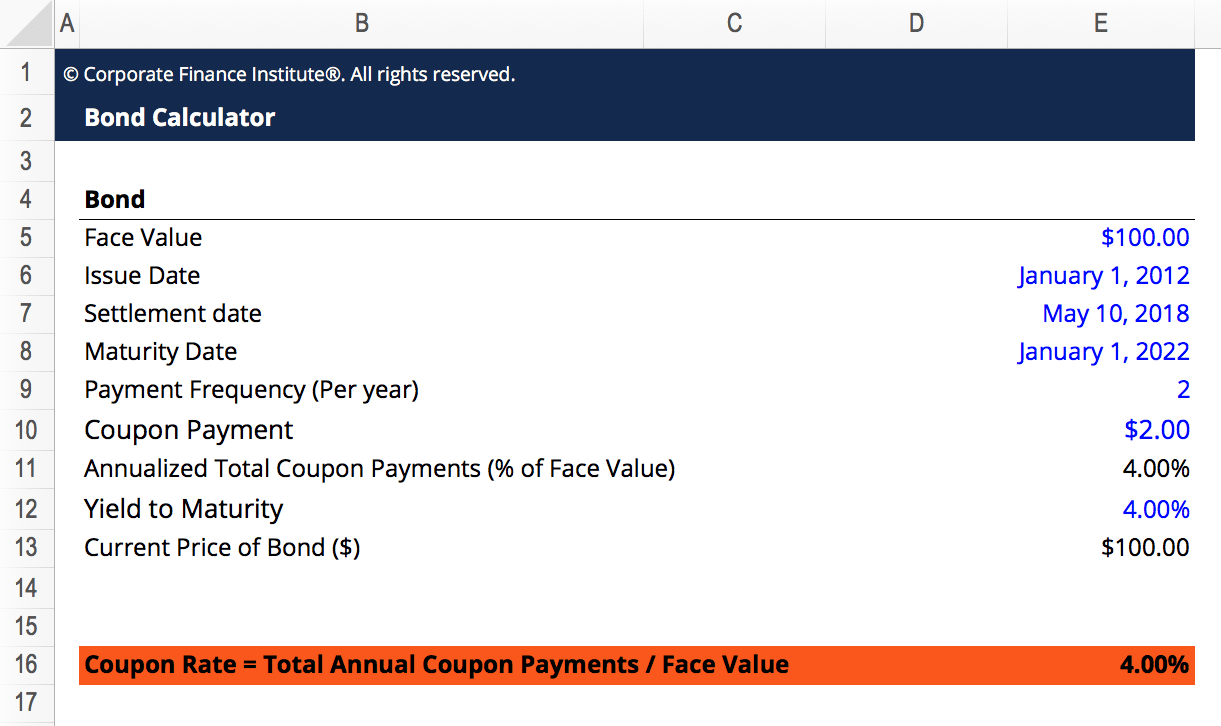

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Coupon Rate vs. Yield-to-Maturity. The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when ...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

Goi Loan - Bond Price, Yield Percentage, Coupon Rate | IndiaBonds This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of the bond. Current yield is simply the current return an investor would expect if he/she held that investment ...

Fixed-income attribution - Wikipedia Of course, the yield curve is most unlikely to behave in this way. The idea is that the actual change in the yield curve can be modeled in terms of a sum of such saw-tooth functions. At each key-rate duration, we know the change in the curve's yield, and can combine this change with the KRD to calculate the overall change in value of the portfolio.

Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we must understand that this calculation completely depends on the annual coupon and bond price.

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, and ...

What is the relationship between coupon rate required yield and price ... When is the yield to maturity equals the coupon rate? When a Bond's Yield to Maturity Equals Its Coupon Rate. If a bond is purchased at par , its yield to maturity is thus equal to its coupon rate, because the initial investment is offset entirely by repayment of the bond at maturity, leaving only the fixed coupon payments as profit. Nov 18 2019

When is a bond's coupon rate and yield to maturity the same? - Investopedia Vikki Velasquez. A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond ...

Post a Comment for "42 coupon rate and yield"