42 how to calculate coupon rate from yield

Coupon Rate Formula - Simple-Accounting.org The coupon rate, or coupon payment, is the yield the bond paid on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity. The prevailing interest rate directly affects the coupon rate of a bond, as well as its market price.Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. How to Calculate After Tax Yield: 11 Steps (with Pictures) - wikiHow 06.05.2021 · Learn the definition. The after-tax yield or after-tax return is the profitability of an investment after all applicable taxes have been paid. The type of tax paid and the investor’s marginal tax rate affect the amount of the after tax yield. The after tax yield may vary depending on whether the investor has to pay income tax or capital gains tax.

How to Calculate Yield in Excel? | Microsoft Excel Tips | Excel ... Using Excel, you can develop a bond yield calculator easily with the help of a number of formulas. You just need to enter the inputs like face value, coupon rate, years to maturity etc and Excel will calculate the bond yield and display it for you. Calculate Yield. Open Excel and save your file as yield.xlsx.

How to calculate coupon rate from yield

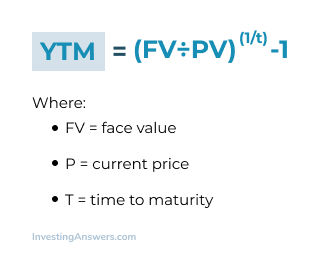

How to Calculate the Yield of a Zero Coupon Bond Using Forward Rates? So We have 1.07. So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%. So we're just taking (1 + the forward rate) for each of these periods. It's a five-year zero-coupon bond so we're gonna go all the way up to forward rate through year five. What Is Coupon Rate and How Do You Calculate It? - Accounting Services A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond with a coupon rate of 6% pays ... How to Calculate Current Yield (Formula and Examples) - Indeed Career Guide Coupon rate = (total annual coupon payment / par value of bond) x 100. Example: A bond with a face value of $200 and a $5 coupon has a coupon rate of 2.5% because ($5 / $200) x 100 = 2.5%. Nominal yield vs. yield to maturity. Nominal yield is another name for the coupon rate. The yield to maturity is the total return you earn if you hold the ...

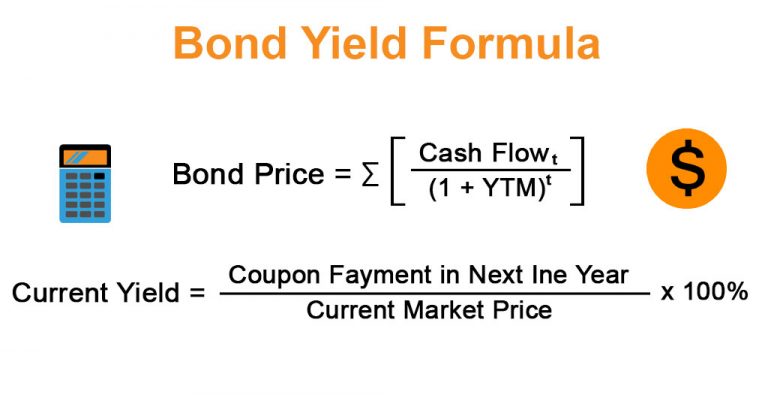

How to calculate coupon rate from yield. Coupon Rate: Formula and Bond Nominal Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond; For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000; Coupon Rate = 6%; Annual Coupon = $100,000 x 6% = $6,000 How to Calculate Yield to Maturity: 9 Steps (with Pictures) 06.05.2021 · Estimate the interest rate by considering the relationship between the bond price and the yield. You don’t have to make random guesses about what the interest rate might be. Since this bond is priced at a discount, we know that the yield to … Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875% Coupon Rate Calculator | Bond Coupon As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value

Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield i - The nominal interest rate on the bond; n - The number of coupon payments received in each year; Practical Example. Assume that you purchase a bond with a nominal coupon rate of 7%. Coupon payments are received, as is common with many bonds, twice a year. Plugging in the calculation formula, you calculate the yield as follows: Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate. Convert Annual Percentage Rate (APR) to Annual Percentage Yield … To calculate APR: Add up all fees and interest to be paid over the life of the loan. Divide the total fees and interest by the principal. Divide the result by the total period of the loan, in years. Multiply the result by 100. The result is your Annual Percentage Rate expressed as a percentage. Example: Calculate Your Daily Credit Card Interest ... How to Construct a Zero Coupon Yield Curve in Excel? - WallStreetMojo Zero-coupon rate for 2 year = 3.5% + (5% - 3.5%)* (2- 1)/ (3 - 1) = 3.5% + 0.75% Zero-Coupon Rate for 2 Years = 4.25% Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25% Conclusion The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products.

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It … Coupon Rate Definition - Investopedia 05.09.2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... How to Calculate Semi-Annual Bond Yield | The Motley Fool 25.11.2016 · When a bond's price is close to its par value, the bond yield is close to its coupon rate. Yet as interest rates in the broader bond market change, bond prices can rise or fall dramatically from ... Price, Yield and Rate Calculations for a Treasury Bill Calculate the ... Price, Yield and Rate Calculations for a Treasury Bill Convert Price to Discount Rate Calculate the Dollar Price for a Treasury Bill These examples are provided for illustrative purposes only and are in no way a prediction of interest rates or prices on any bills, notes or bonds issued by the Treasury. In actual practice, Treasury uses a mainframe and generally does not round prior to ...

How do you calculate the interest rate of a bond? A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. How do you calculate annual interest on a bond? Multiply the bond's face value by the ...

Yield To Maturity Vs. Coupon Rate: What's The Difference? To calculate the bond's coupon charge, divide the overall annual curiosity funds by the face worth. In this case, the overall annual curiosity cost equals $10 x 2 = $20. ... Yield to Maturity vs. Coupon Rate: An Overview When buyers think about shopping for bonds they want to take a look at two important items of data: the yield to maturity ...

Current Yield of a Bond - Meaning, Formula, How to Calculate? It also refers to bonds whose coupon rates are lower than the market interest rate and thus trade for less than their face value in the secondary market. read more is greater than the annual coupon rate because of the inverse relationship that exists between the yield of a bond and its market price. Similarly, the yield on a premium bond is lower than its annual coupon rate and …

Current Yield Formula | Calculator (Examples with Excel Template) - EDUCBA Current Yield of a Bond can be calculated using the formula given below Current Yield = Annual Coupon Payment / Current Market Price of Bond For Bond 1 Current Yield = $70 / $920 Current Yield = 7.61% For Bond 2 Current Yield = $80 / $1000 Current Yield = 7.27%

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's yield, or coupon rate, is computed by dividing its coupon payment by its face value. An updated yield rate can be computed by dividing its coupon by the current market price of the bond....

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

Coupon Rate of a Bond - WallStreetMojo Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower's failure to repay the loan or meet debt obligations.

Coupon Rate - Meaning, Calculation and Importance - Scripbox Yield to Maturity (YTM) = { (C) + [ (FV - PV) ÷ t]} ÷ [ (FV + PV) ÷ 2] Where, C - Coupon Payment FV - Face value of the bond PV - Current price of the bond t - no. of years to maturity YTM aims to calculate a bond's yield based on its current market price.

How to calculate yield to maturity in Excel (Free Excel 12.09.2021 · How to Calculate Yield to Maturity (YTM) in Excel 1) Using the RATE Function. Suppose, you got an offer to invest in a bond. Here are the details of the bond: Par Value of Bond (Face Value, fv): $1000; Coupon Rate (Annual): 6%; Coupons Per Year (nper): 2. The company pays interest two times a year (semi-annually). Years to Maturity: 5 years ...

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell A3, enter the formula "=A1*A2" to yield the total annual coupon payment. Moving down the spreadsheet, enter the par value of your bond in cell B1. Most bonds have par values of $100 or...

Learn How Coupon Rate Affects Bond Pricing - Corporate Finance Institute If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

How do I Calculate Zero Coupon Bond Yield? (with picture) - wiseGEEK It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face Value/Price) 1/n - 1. 📦Amazon Doesn't Want You to Know About This Plugin

How to Calculate Current Yield (Formula and Examples) - Indeed Career Guide Coupon rate = (total annual coupon payment / par value of bond) x 100. Example: A bond with a face value of $200 and a $5 coupon has a coupon rate of 2.5% because ($5 / $200) x 100 = 2.5%. Nominal yield vs. yield to maturity. Nominal yield is another name for the coupon rate. The yield to maturity is the total return you earn if you hold the ...

Post a Comment for "42 how to calculate coupon rate from yield"